304 & 316 Stainless Steel Tubing Supplier for Southeast Asian Markets

Navigating Southeast Asia's complex stainless steel market is a major challenge. Missed opportunities and supply chain issues can quickly undermine growth. We offer a clear roadmap to success.

Mastering the Southeast Asian stainless steel tubing market requires a deep understanding of local demand, a resilient and digitized supply chain, and a focus on providing high-quality, corrosion-resistant 304 and 316 grades. Success hinges on combining production strength with tailored, one-stop service solutions.

The potential in Southeast Asia is undeniable, but seizing it requires more than just a competitive price list. It demands a strategic approach that aligns product quality with market-specific needs and logistical excellence. As someone who has spent years building supply chains in this region, I've learned that success is built on a foundation of reliability, adaptability, and a deep respect for the unique demands of each market. Let's explore the key factors that separate the leading suppliers from the rest.

What Defines the Southeast Asian Stainless Steel Tubing Market?

The market looks promising but is full of complexities. Unseen economic and environmental factors can easily derail plans. We will clarify the landscape for you.

The Southeast Asian stainless steel tubing market is defined by rapid urbanization, strong government investment in infrastructure, and a growing demand for durable materials that can withstand the region's humid, often corrosive, climate.

The incredible economic dynamism across Southeast Asia is something I witness firsthand on every business trip. From the sprawling infrastructure projects in Indonesia to the booming manufacturing sector in Vietnam, the entire region is undergoing a massive transformation. This isn't just about building more; it's about building better and building to last. This is where stainless steel, particularly grades 304 and 316, becomes not just a component, but a critical investment. The region's tropical climate—characterized by high humidity, heavy rainfall, and, in many areas, saline coastal air—is incredibly tough on traditional materials. I remember a conversation with an engineering contractor in Manila who told me, "Cosmos, anything less than high-quality stainless steel is a maintenance nightmare waiting to happen." This sentiment is echoed across the industry. Decision-makers are increasingly prioritizing lifecycle cost over upfront price, creating a significant opportunity for suppliers who can deliver proven quality and durability.

Key Market Drivers by Country

| Country | Primary Demand Driver | Key Industries |

|---|---|---|

| Vietnam | Foreign Direct Investment (FDI) | Manufacturing, Electronics, Food Processing |

| Indonesia | Government Infrastructure Spending | Construction, Transportation, Energy |

| Thailand | Automotive & Medical Device Sector | Automotive Manufacturing, Healthcare |

| Malaysia | Oil & Gas, High-Tech Manufacturing | Petrochemical, Electronics, Construction |

| Philippines | Urban Development & Construction | Real Estate, Water Treatment, Infrastructure |

This table provides a simplified view, but it highlights the diverse needs within the region. A successful supplier must be agile enough to cater to these different industrial verticals.

What is Driving the Demand for 304 & 316 Tubing in the Region?

Guessing market demand is a risky business strategy. Misjudging it leads to costly inventory errors and missed sales. We'll show you the real drivers.

Demand for 304 and 316 stainless steel tubing is driven by massive infrastructure projects, industrial manufacturing growth, and stringent construction standards requiring high corrosion resistance, particularly for 316 grade in coastal and high-humidity applications.

While both 304 and 316 stainless steel are workhorses of the industry, the specific demand drivers in Southeast Asia often push clients towards the superior corrosion resistance of 316. Grade 304 is an excellent, cost-effective choice for general-purpose applications like kitchen equipment, indoor architectural features, and freshwater piping. However, the addition of molybdenum in 316 grade gives it a crucial advantage against chlorides, which are prevalent in coastal environments and many industrial processes. I recall a client in Malaysia who was developing a coastal desalination plant. They initially considered using 304 to reduce costs, but after we walked them through the long-term risks of pitting and crevice corrosion from saltwater exposure, they understood that 316 was the only viable choice for ensuring the plant's longevity and safety. This shift from a price-first to a quality-first mindset is a significant trend.

Construction & Architecture

In landmark projects across cities like Singapore and Bangkok, architects are specifying 316 stainless steel for facades, railings, and structural components exposed to the elements. Its ability to maintain its finish and structural integrity in polluted and humid urban environments makes it a premium choice.

Industrial & Food Processing

For the region's growing food and beverage, pharmaceutical, and chemical processing industries, hygiene and resistance to corrosive cleaning agents are paramount. Here, both 304 and 316 are essential, with the choice depending on the specific chemicals and temperatures involved. The smooth, non-porous surface of stainless steel tubing is critical for preventing contamination.

What are the Biggest Challenges for Suppliers in Southeast Asia?

Entering this promising market can seem straightforward. But hidden logistical, cultural, and competitive hurdles can stop you cold. We'll expose the key challenges.

Suppliers face challenges including complex logistics across an archipelago of nations, intense price competition from local and regional players, navigating varying import regulations, and the constant pressure to guarantee consistent quality and reliable delivery schedules.

Supplying to Southeast Asia is not like supplying to a single, homogenous market. It's a collection of diverse countries, each with its own customs procedures, infrastructure quality, and business culture. The first major hurdle is logistics. A shipment from China to Singapore is relatively simple, but delivering that same material to a remote project site in the Philippines or Indonesia involves multiple stages of sea and land transport, each with potential for delay. A few years ago, a shipment of ours was held up for two weeks at a port due to a sudden change in documentation requirements, which taught us a valuable lesson about the importance of having expert local partners on the ground. Beyond logistics, there's intense price pressure. While the demand for quality is rising, cost remains a major factor for many buyers. This creates a difficult balancing act: you must offer a premium, reliable product while remaining competitive.

Logistical Complexity

Managing shipping, customs, and last-mile delivery across thousands of islands and multiple countries requires a robust and flexible logistics network. Delays are not just inconvenient; they can halt multi-million dollar construction projects.

Quality Assurance and Trust

Buyers are wary of inconsistent quality. A supplier's reputation is built on their ability to consistently deliver material that meets specified standards, backed by verifiable Mill Test Certificates (MTCs)[^1]. Any failure here can permanently damage a business relationship.

Market Fragmentation

Each country has unique standards, preferences, and competitive landscapes. A one-size-fits-all sales and marketing strategy is doomed to fail. Building strong, local relationships is essential to understanding and meeting the specific needs of each market.

How Can Suppliers Overcome These Supply Chain Challenges?

Constant supply chain disruptions are incredibly costly. Simply reacting to problems is not a sustainable strategy. A proactive, technology-driven approach is essential.

Overcoming challenges requires a multi-pronged strategy: building strong local partnerships for on-the-ground intelligence, establishing regional warehousing for faster delivery, leveraging digital tools for real-time supply chain visibility, and offering flexible, customized one-stop solutions.

At MFY, we realized early on that we couldn't treat Southeast Asia as just another export destination. We had to build a supply chain for the region. The old model of shipping directly from a port in China and hoping for the best is no longer competitive. The solution lies in a hybrid approach that combines our production strength with a smart, localized, and digitized network. A key part of our strategy has been investing in digital platforms that provide our clients—and our own teams—with complete transparency. When a contractor in Vietnam can log in and see exactly where their shipment of 316 tubing is, it builds immense trust and allows them to plan their project schedules with confidence. This is a radical departure from the opaque supply chains of the past.

The Power of Digitalization

A digital backbone allows for real-time tracking, inventory management, and streamlined communication. It turns the supply chain from a black box into a transparent, predictable process. This reduces uncertainty for the customer and allows us to proactively manage potential disruptions before they become major problems.

Building a Resilient, Localized Network

We've focused on creating a "one-stop solution." This means we don't just sell steel; we manage the entire process. By partnering with reliable local logistics providers and establishing strategically located inventory hubs, we can cut down delivery times from weeks to days. This agility is a powerful competitive advantage, especially for clients who need materials on a tight schedule.

What Technical Standards Must High-Quality Tubing Meet for This Market?

Supplying tubing that just "looks right" is not enough. If it fails to meet critical local and international specifications, your reputation is at risk.

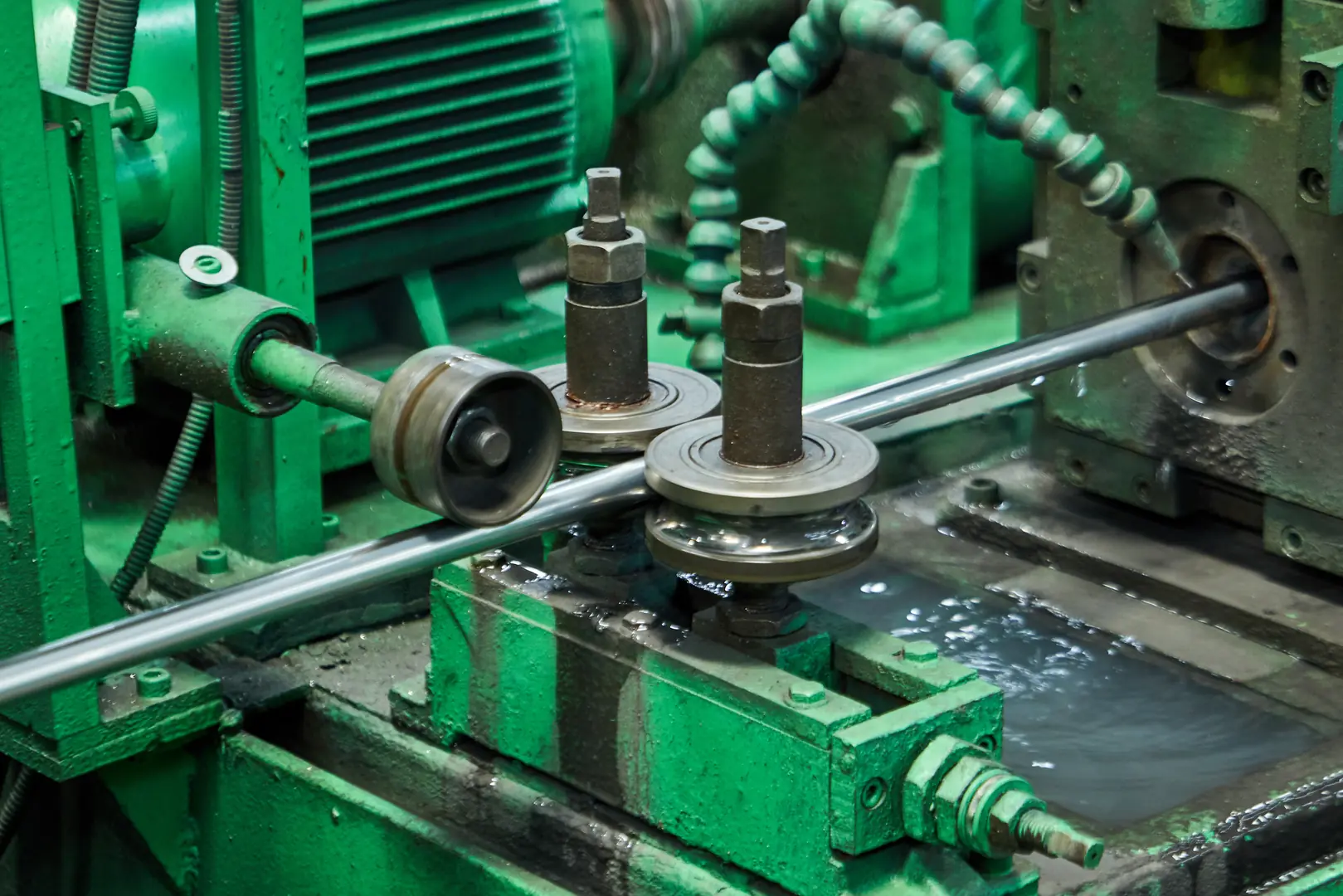

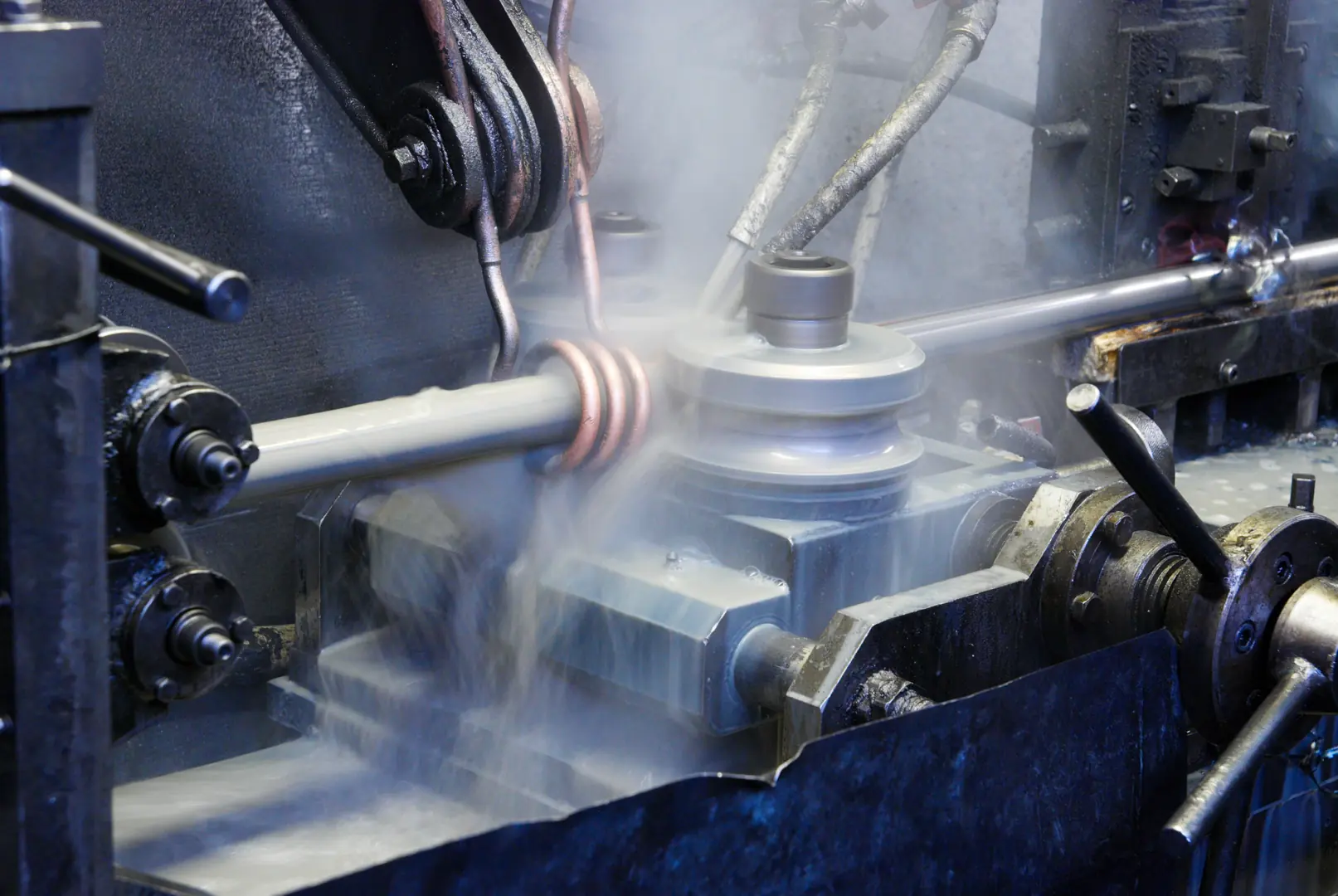

High-quality tubing must meet international standards like ASTM A312 for welded and seamless pipe. Key technical verifications include precise chemical composition—especially the molybdenum content in 316 for corrosion resistance—and impeccable weld seam integrity for long-term durability.

Ultimately, everything comes down to the quality of the material itself. In demanding environments like those found in Southeast Asia, there is no room for error. A pipe that fails prematurely can have catastrophic consequences, both financially and in terms of safety. This is why we are obsessive about quality control and documentation. Every coil and pipe that leaves our facility is accompanied by a comprehensive Mill Test Certificate (MTC) that details its exact chemical makeup and mechanical properties. This isn't just paperwork; it's our promise of quality. For grade 316, we pay special attention to the molybdenum content, ensuring it is consistently above 2.0% to guarantee the superior corrosion resistance our clients depend on.

Key Quality Checkpoints: 304 vs. 316

| Property | Grade 304 (Typical) | Grade 316 (Typical) | Importance in SEA Market |

|---|---|---|---|

| Chromium (Cr) | 18.0 - 20.0% | 16.0 - 18.0% | Primary element for general corrosion resistance. |

| Nickel (Ni) | 8.0 - 10.5% | 10.0 - 14.0% | Improves formability and ductility. |

| Molybdenum (Mo) | - | 2.0 - 3.0% | Critical for resisting chloride-induced pitting and corrosion. |

| Weld Integrity | High | High | Essential for pressure applications and structural safety. |

Verifying these properties is non-negotiable. We encourage our clients to perform their own independent testing, as we are confident that our materials will always meet or exceed the required specifications. This transparency is the cornerstone of a lasting partnership.

Conclusion

Success in the Southeast Asian 304 and 316 stainless steel tubing market is about more than logistics and price. It requires a deep commitment to quality, a resilient and digitized supply chain, and a focus on delivering solutions, not just products, to build lasting trust.

Have Questions or Need More Information?

Get in touch with us for personalized assistance and expert advice.