Драйверы цен на трубы из нержавеющей стали: Никель, молибден и стоимость энергии

Struggling with unpredictable stainless steel pipe prices that wreak havoc on your project budgets? This volatility isn't random; it's a direct reflection of a few key cost drivers. Gaining insight into these factors is the first step toward mastering your procurement strategy and protecting your bottom line.

The price of stainless steel pipe is primarily determined by three key factors: the cost of alloying elements, particularly nickel and molybdenum, and energy expenses. Nickel dictates the fundamental corrosion resistance and cost of popular austenitic grades, while molybdenum provides enhanced resistance for specialized applications, and energy costs influence every stage of production from melting to finishing.

For anyone involved in sourcing or using stainless steel pipes, from construction contractors to equipment manufacturers, these price swings can feel like navigating a storm without a compass. The uncertainty complicates bidding on new projects, managing inventory, and maintaining profitability. But what if you could better forecast these changes? By understanding the "why" behind the price, you can shift from a reactive to a proactive procurement model, making smarter, more strategic purchasing decisions.

This isn't just about abstract market forces; it's about the tangible impact on your operations. The global demand for nickel in electric vehicle batteries1, geopolitical events affecting molybdenum mining, and fluctuating energy tariffs all ripple directly down to the cost of the pipes essential for your projects. In my role at MFY, I’ve seen how a lack of understanding of these drivers can lead to costly mistakes. Conversely, I’ve also guided partners who, by grasping these fundamentals, have successfully navigated this complexity. They’ve learned to anticipate market shifts, align their purchasing with favorable conditions, and ultimately build more resilient and profitable supply chains. This article will delve into each of these core drivers, providing the clarity you need to turn market volatility into a competitive advantage.

What role does nickel play in determining stainless steel pipe prices?

Finding it difficult to explain to your stakeholders why the cost of 304 or 316 stainless steel pipes can change so dramatically from one month to the next? This pricing puzzle often hinges on the volatile market for a single, critical element: nickel.

Nickel is a fundamental alloying element in the most common stainless steel grades, such as 304 and 316, providing essential corrosion resistance, toughness, and formability. Its price on the London Metal Exchange (LME) is a primary component of the alloy surcharge, creating a direct and significant impact on the final cost of stainless steel pipes.

Throughout my career, I've seen how nickel's market behavior can make or break a project's budget. It's far more than a simple commodity; its value is intertwined with a complex web of global factors. We've seen everything from mining disruptions in Indonesia and geopolitical tensions involving Russia to a structural shift in demand driven by the electric vehicle (EV) battery industry. This creates a challenging environment for procurement managers who need predictability. I recall a client in India, a large-scale manufacturer of food processing equipment, who was caught off guard by a sudden 20% surge in 304 pipe prices. The spike was directly linked to a speculative run on the LME nickel market. It forced them to absorb losses on existing contracts and hastily requote future projects, damaging both their margins and their credibility with customers. This experience highlighted a crucial lesson: passively accepting price quotes is no longer a viable strategy. To thrive, you must understand the underlying forces at play, particularly the dominant role of nickel.

The relationship between nickel and stainless steel pipe pricing is both direct and transparent, yet it's governed by complex market dynamics that can seem opaque from the outside. By breaking down how nickel physically contributes to the steel, how its market is influenced by external forces, and how mills translate its cost to you, we can demystify the pricing structure. This understanding is the foundation of any sophisticated procurement strategy, transforming you from a price-taker to an informed market participant. At MFY, we believe that empowering our clients with this knowledge is key to building lasting, successful partnerships.

The Direct Cost Component: Nickel as a Raw Material

The most direct impact of nickel on price comes from its role as a key ingredient. For austenitic grades, which are the workhorses of the industry, nickel is essential. In Type 304 stainless steel, nickel typically makes up about 8% to 10.5% of the total weight. For Type 316, which offers superior corrosion resistance, that content increases to 10% to 14%. This percentage is not trivial; it means that a significant portion of the material cost of a pipe is tied directly to the price of one metal. When the price of nickel on the London Metal Exchange (LME) doubles, the raw material cost for a ton of 316 stainless steel can increase by a staggering amount, a cost that is inevitably passed down the supply chain.

This direct correlation is why anyone purchasing stainless steel must pay close attention to the nickel market. I worked with a construction contractor in Southeast Asia on a major desalination plant project, which required vast quantities of 316L pipe due to the highly corrosive marine environment. The project's timeline was flexible, and their budget was tight. We provided them with weekly insights into the LME nickel market and the resulting surcharge forecasts. By tracking a period of high volatility, we identified a two-week window where prices dipped nearly 15%. Acting decisively, the client placed their entire order within that window, saving over a hundred thousand dollars on their material cost—a significant sum that directly boosted their project's profitability.

This case perfectly illustrates that the price you pay is not arbitrary. It's a calculated figure heavily weighted by the real-time cost of its constituent parts. Ignoring the nickel market is akin to ignoring the weather when planning a voyage. As an integrated producer and trader, MFY maintains a constant watch on these trends, using this intelligence not just for our own production planning but as a crucial advisory service for our partners. We aim to provide the foresight that turns market volatility from a risk into an opportunity.

Market Volatility and Geopolitical Influences

While the percentage of nickel in steel is a fixed calculation, the price of nickel itself is anything but stable. Its market is notoriously volatile, subject to a wide range of geopolitical and macroeconomic forces. Major nickel-producing nations like Indonesia, the Philippines, and Russia hold significant sway over global supply. For instance, when Indonesia, the world's largest producer, implemented a ban on the export of unprocessed nickel ore, it was a deliberate move to force investment into domestic smelting facilities. This policy single-handedly constricted global supply and sent prices upward, a shock that was felt across the entire stainless steel industry.

Adding a powerful new dimension to this volatility is the soaring demand from the electric vehicle (EV) industry. Stainless steel manufacturing accounts for approximately 70% of global nickel consumption, but the EV battery sector is the fastest-growing source of new demand. An average EV battery can contain over 25 kilograms of high-purity Class 1 nickel, and as the world transitions to electric mobility, this competition is fundamentally reshaping the market. According to Benchmark Minerals, demand for nickel from the battery sector is growing at a much faster rate than from the stainless steel sector. This means the steel industry, which was once the undisputed king of nickel consumption, now has a formidable rival.

This new competitive landscape creates a higher price floor and amplifies volatility. A strike at a key mine, a new environmental regulation, or a surge in EV sales can have an immediate and pronounced impact on LME prices. For procurement managers, this is the "new normal." The strategies of the past—relying on historical price averages or yearly contracts with fixed prices—are becoming obsolete. Today, a successful strategy requires a more dynamic approach, one that constantly monitors these disparate global events and understands their potential to influence the cost of your next shipment of stainless steel pipes.

The Surcharge Mechanism: How Mills Pass on Costs

To manage the extreme price volatility of raw materials, steel mills developed the "alloy surcharge" system decades ago. This mechanism is crucial for every buyer to understand, as it separates the fluctuating cost of raw materials from the mill's operational costs. The final price you pay for a stainless steel pipe is essentially composed of two parts: the base price and the alloy surcharge. The base price covers the mill's conversion costs—labor, energy, machinery, and profit. This portion is relatively stable. The alloy surcharge, however, is a variable component that changes monthly (or sometimes quarterly) to reflect the real-world cost of the alloying elements, primarily nickel, chromium, and molybdenum.

This system provides critical transparency. When you receive a quote, the surcharge isn't an arbitrary fee; it's a direct pass-through of commodity market prices. Mills calculate this by taking the average price of an element like nickel on the LME over a specific period and plugging it into a set formula based on the grade's composition. This is why the price for 316 pipe will have a higher surcharge than 304 pipe—it contains more nickel and the addition of expensive molybdenum.

To make this clearer, here is a simplified breakdown of how pricing is structured:

| Component | Описание | Volatility |

|---|---|---|

| Base Price | Covers the mill's processing, labor, overhead, and margin. | Низкий |

| Alloy Surcharge | A variable fee based on the monthly average market price of nickel, chromium, molybdenum, etc. | Высокий |

| Extras | Additional charges for special testing, polishing, specific cutting, or packaging. | Project-Specific |

From our perspective at MFY, this mechanism is essential for maintaining trust with our clients. It allows us to have open conversations about pricing. When a client asks why their price has increased by 7% this month, we can point directly to the published LME nickel data and the corresponding change in the alloy surcharge. It removes ambiguity and helps our clients explain these cost variations to their own customers and stakeholders, fostering a more collaborative and predictable supply chain for everyone involved.

Nickel is essential for 304/316 stainless steelПравда

Nickel provides crucial corrosion resistance and formability in austenitic stainless steel grades, constituting 8-14% of their composition.

EV batteries don't affect nickel pricesЛожь

The electric vehicle industry's growing demand for high-purity nickel is creating new competition and amplifying price volatility in the nickel market.

How do molybdenum prices influence the stainless steel pipe market?

Are you specifying materials for a harsh environment and wondering why the jump in cost from a 304 to a 316 grade is so significant? A large part of that price premium is driven by a lesser-known but powerful alloying element: molybdenum.

Molybdenum is a key alloying agent, typically added at 2-3% in Grade 316 stainless steel, to significantly enhance resistance to pitting and crevice corrosion, especially in chloride-rich environments. Its price, which can be highly volatile, directly impacts the alloy surcharge and the total cost of molybdenum-bearing stainless steel pipes.

While nickel forms the backbone of corrosion resistance in austenitic stainless steels, molybdenum provides the specialized reinforcement needed for more demanding applications. Think of it as the ingredient that takes a standard material and makes it "high-performance." This is why 316 and other "moly" grades2 are indispensable in industries like marine construction, chemical processing, pharmaceuticals, and desalination, where standard stainless steel would fail. However, this superior performance comes at a cost. The molybdenum market, while smaller than nickel's, has its own unique supply and demand dynamics that can lead to dramatic price swings. I recently advised a client in the Middle East that engineers a contractor for a large petrochemical facility. They were tempted to use a leaner, less expensive grade to cut costs. We analyzed the long-term operational risks and the historical price volatility of molybdenum, demonstrating that the upfront savings would be quickly erased by maintenance costs and potential downtime. By showing them the data, we helped them confidently choose 316L, securing the plant's integrity and preventing a costly future failure.

The influence of molybdenum on the stainless steel market is a perfect example of how a relatively small component by weight can have an outsized impact on both performance and price. Its role is highly specific, its market is concentrated, and its price can be incredibly volatile, creating a distinct set of challenges and considerations for procurement professionals. Understanding molybdenum is key to making informed decisions about grade selection and cost management, especially for projects where failure is not an option. At MFY, we guide our clients through this analysis, ensuring they balance upfront costs with the total cost of ownership over the lifetime of their assets.

The Performance Enhancer for Harsh Environments

The primary function of molybdenum in stainless steel is to enhance its resistance to localized corrosion, particularly pitting and crevice corrosion caused by chlorides. Chlorides are ubiquitous in marine environments, de-icing salts, and many chemical processing streams. While standard Type 304 stainless steel offers excellent general corrosion resistance, it can be susceptible to this type of localized attack, which can lead to rapid and catastrophic failure. The addition of just 2-3% molybdenum in Type 316 creates a more robust and passive surface layer, dramatically increasing its resilience. This is quantified by the Pitting Resistance Equivalent Number (PREN)3, a formula where molybdenum has a significantly higher weighting factor than chromium or nickel, reflecting its potent effect.

This performance boost is not a luxury; it's a necessity in many critical applications. For example, a client of ours who manufactures heat exchangers for the chemical industry relies exclusively on 316L pipes. The chemicals their equipment handles are highly corrosive, and a pinhole leak caused by pitting would not only lead to equipment failure but also pose a significant safety and environmental hazard. The higher upfront cost of 316L is a non-negotiable insurance premium against such events. The premium paid for molybdenum is a direct investment in the safety, reliability, and longevity of the final product.

The decision to specify a moly-bearing grade is therefore a technical one based on risk assessment. It requires a thorough understanding of the service environment. We often consult with clients during the design phase, helping them analyze factors like chemical concentration, operating temperature, and chloride levels. By matching the material properties to the application's demands, we help them avoid both over-engineering (paying for performance they don't need) and under-engineering (risking premature failure by cutting corners on material selection). This collaborative approach ensures that the investment in molybdenum delivers real, measurable value.

Supply, Demand, and Price Volatility

The molybdenum market is significantly different from the nickel market. Global production is concentrated in just a few countries, with China, Chile, the United States, and Peru accounting for the vast majority of supply. Molybdenum is often mined as a byproduct of copper, meaning its supply can be influenced by the economics of the copper market, not just its own demand. This concentrated and sometimes inelastic supply chain makes the market susceptible to disruptions. A single large mine going offline due to a strike or a technical issue can have an immediate impact on global availability and prices.

Demand for molybdenum is primarily driven by the steel industry, where it's used not only in stainless steel but also as a hardening agent in high-strength alloy steels used in pipelines, construction, and automotive components. While it lacks the headline-grabbing demand driver of EV batteries that nickel has, its steady industrial demand keeps prices sensitive to global economic growth. During periods of rapid industrial expansion, demand can outstrip supply, leading to sharp price spikes. We saw this in early 2023 when prices skyrocketed to record highs due to a combination of strong demand and supply constraints.

For buyers, this volatility adds another layer of complexity to the alloy surcharge. The surcharge for a 316 pipe is a function of both nickel and molybdenum prices. A procurement manager might see a stable nickel market but be surprised by a rising surcharge, driven entirely by a rally in molybdenum. This underscores the importance of working with a supplier who provides a transparent breakdown of the surcharge components. At MFY, we track the prices for ferro-molybdenum just as closely as we track LME nickel, allowing us to forecast these changes and advise our clients on the best times to place orders for moly-bearing grades.

Calculating the "Moly Premium" in Your Procurement Strategy

The price difference between a 304 and a 316 pipe is often referred to as the "moly premium." This premium is not a fixed number; it fluctuates directly with the market price of molybdenum. Understanding how to analyze this premium is a key strategic skill. It involves looking beyond the total price of the pipe and evaluating the relative cost of the enhanced performance that molybdenum provides. Is the current moly premium high or low by historical standards? Answering this can inform critical procurement decisions.

For example, a distributor client of ours holds inventory of both 304 and 316 pipes. We provide them with data on the historical ratio between the 304 and 316 surcharges. When they see that the molybdenum price is historically low, resulting in a smaller-than-usual premium for 316, they know it's an opportune time to increase their inventory of the higher-grade material. They can purchase it at a favorable cost and are well-positioned when demand from their customers in the marine and chemical sectors picks up. Conversely, when the moly premium is extremely high, they might adjust their strategy to manage cash flow.

Here’s a simplified table illustrating the thought process:

| Market Condition | Molybdenum Price | "Moly Premium" (316 vs 304) | Strategic Action for Buyer |

|---|---|---|---|

| Bear Market | Низкий | Small | Increase inventory of 316/316L. The performance upgrade is cheap. |

| Normal Market | Stable | Average | Maintain balanced inventory based on regular customer demand. |

| Bull Market | Высокий | Large | Purchase 316/316L based on firm orders rather than for stock. Conserve cash. |

This type of strategic thinking moves procurement from a simple act of buying to an integral part of a company's financial and operational strategy. It’s a level of sophistication we encourage in all our partners, providing the market intelligence they need to execute it effectively. By understanding the drivers behind the moly premium, they can optimize their inventory, manage risk, and better serve their own end-users.

Молибден повышает устойчивость к точечной коррозииПравда

Adding 2-3% molybdenum to stainless steel significantly improves resistance to localized corrosion in chloride environments.

Molybdenum is a primary productЛожь

Molybdenum is typically mined as a byproduct of copper production, not as a primary mining target.

What impact do energy costs have on the production and pricing of stainless steel pipes?

Have you ever considered that the cost of electricity and natural gas has a direct, albeit less visible, impact on the price of your stainless steel pipes? While alloys are a major factor, the immense energy required for steel production is a critical component of the final price.

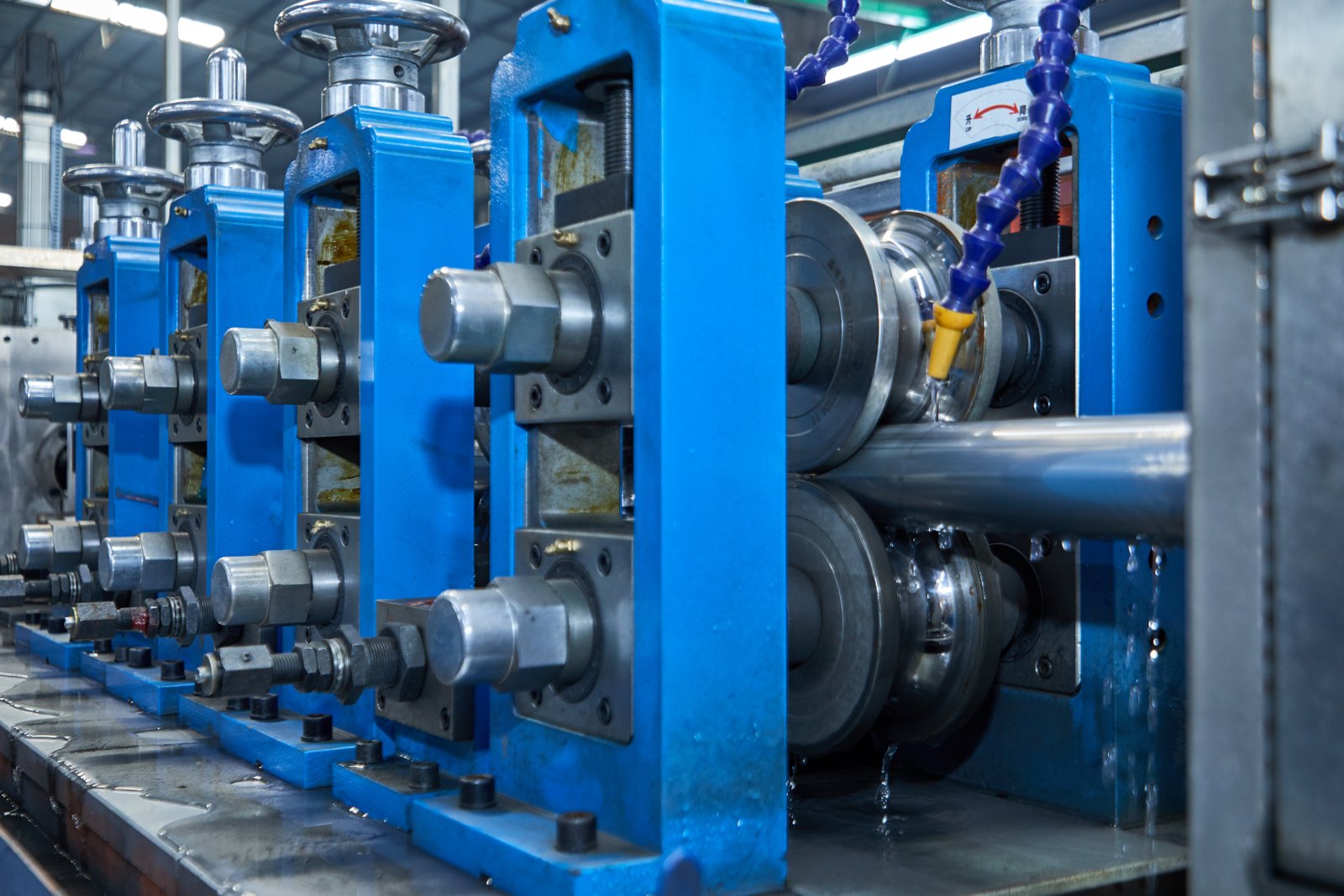

Energy is one of the largest operational expenses in stainless steel manufacturing, directly influencing the "base price" component. The energy-intensive processes, from melting scrap in an Electric Arc Furnace (EAF) to reheating and annealing, mean that significant fluctuations in electricity and natural gas prices are inevitably reflected in the pipe's final cost.

At MFY, our integrated supply chain includes energy-intensive processes like cold-rolling and tube manufacturing. We experience firsthand how spikes in energy tariffs can compress margins. This isn't a cost that can be easily absorbed; it's a fundamental input that must be accounted for in pricing. Unlike the alloy surcharge, which is transparent and tied to public commodity markets, energy costs are embedded within the mill's base price. This makes them harder for buyers to track but no less important. I recall a period when regional natural gas prices surged unexpectedly due to a cold winter and supply disruptions. As a result, we saw nearly every mill in the region issue a base price increase within the same quarter, a direct consequence of the rising cost to fuel their annealing furnaces. This demonstrates that a comprehensive procurement strategy must look beyond alloys and consider the broader energy landscape.

The journey from raw scrap metal to a finished, polished stainless steel pipe is a story of immense thermal and mechanical energy. Every step consumes a significant amount of power, making steel mills some of the largest energy consumers in the manufacturing sector. While the alloy surcharge captures the cost of materials, the energy cost is a core part of the conversion process itself. Understanding where and how this energy is used allows buyers to appreciate the full cost structure of the products they purchase and to better anticipate price movements that are not related to the LME or alloy fluctuations.

The Energy-Intensive Journey from Scrap to Pipe

The production of stainless steel is fundamentally a process of melting and refining, and this requires enormous amounts of energy. The most common production method today is the Electric Arc Furnace (EAF), which uses powerful electric arcs to melt recycled stainless steel scrap and other raw materials. The energy required for this single step is massive; it can take between 400 and 600 kilowatt-hours (kWh) of electricity to produce a single ton of liquid steel. To put that in perspective, that's enough energy to power an average home for several weeks. But the energy consumption doesn't stop there.

After the initial melting and refining, the steel must be cast and then hot-rolled or cold-rolled into its initial shape (like a hollow). Each of these steps requires the steel to be reheated in massive natural gas-fired furnaces to make it malleable. Following this, the pipe undergoes an annealing process, where it is heated again to a specific temperature and then cooled to relieve internal stresses and achieve the desired mechanical properties like strength and ductility. For seamless pipes, a piercing process adds another energy-intensive heating step. When you add up the electricity for the EAF, motors, and lighting, plus the natural gas for the reheating and annealing furnaces, the total energy footprint is substantial.

This high consumption makes steel mills extremely sensitive to energy price fluctuations. A 10% increase in the industrial price of electricity or natural gas translates directly into a higher cost of production per ton of steel. As these costs are fundamental to operations, they are inevitably factored into the base price that is passed on to customers.

How Global Energy Markets Ripple into Steel Prices

The price of energy is not set in a vacuum; it is determined by complex global and regional markets influenced by everything from geopolitics to weather patterns. A disruption to natural gas supplies in one part of the world can lead to higher prices for Liquefied Natural Gas (LNG) globally, affecting manufacturing costs in another. Similarly, national energy policies, investments in renewable energy, and the price of carbon credits can all influence the industrial electricity tariffs that mills must pay. For buyers of stainless steel pipe, this means that events seemingly unrelated to the steel industry can have a direct financial impact.

Consider a distributor based in a region with stable energy prices. They might be surprised to see base price increases from a supplier mill located in a different country. The cause could be a drought in the supplier's region that has reduced hydropower capacity, forcing a greater reliance on more expensive fossil fuels for electricity generation. This is a key reason why having a geographically diversified supply chain can be a strategic advantage, as it mitigates the risk of being over-exposed to regional energy price shocks.

At MFY, our global business perspective gives us insight into these interconnected systems. We monitor not only metal commodity markets but also key energy markets4 that impact our production costs and those of our competitors. This allows us to anticipate shifts in base prices and provide our clients with a more holistic view of market trends. We can explain why a base price is changing, linking it to real-world energy market dynamics rather than leaving it as an unexplained increase.

The Role of Efficiency and Technology in Mitigating Costs

In an environment of volatile and often rising energy costs, energy efficiency is not just an environmental goal—it is a critical competitive advantage. For steel manufacturers, investing in technology to reduce energy consumption per ton of pipe is one of the most effective ways to control the base price and maintain profitability. This is a major focus of our operational strategy at MFY. We have made significant capital investments in our production facilities to enhance efficiency at every stage.

This includes upgrading to more modern, energy-efficient annealing furnaces that use advanced combustion control systems and better insulation to reduce natural gas consumption. We employ sophisticated process controls and automation in our tube mills to optimize production flow, minimize scrap, and reduce the need for energy-intensive rework. Furthermore, our commitment to digital innovation extends to our production floors, where we use data analytics to monitor energy consumption in real-time, identify areas of waste, and implement continuous improvement initiatives.

These investments have a direct benefit for our clients. By keeping our own conversion costs as low as possible, we can offer a more stable and competitive base price. When a potential customer compares our quote with that of a competitor operating older, less efficient equipment, the difference in the base price can often be traced back to these investments in technology and efficiency. It transforms the conversation from a simple price comparison to a discussion about operational excellence and long-term cost stability.

Energy costs affect stainless steel pipe pricesПравда

Energy is one of the largest operational expenses in stainless steel manufacturing, and price fluctuations directly impact the base price of pipes.

Alloy costs are the only price factorЛожь

While alloy costs are important, energy expenses during production are equally critical in determining the final pipe price.

How can manufacturers mitigate price fluctuations in materials and energy?

As a manufacturer, are you constantly reacting to volatile material and energy costs, feeling like you have little control over your own pricing? This is a major challenge, but proactive strategies can be implemented to build resilience and gain a competitive edge.

Manufacturers can mitigate price fluctuations by adopting a multi-faceted strategy that includes vertical supply chain integration for better cost control, investing in energy-efficient technology to lower operational expenses, and driving product innovation to develop material alternatives that are less dependent on volatile commodities.

In my position at MFY, I've championed this approach. We didn't just accept market volatility as a given; we actively reshaped our business to manage it. By integrating raw material trading with our production, we gained crucial foresight and purchasing power. This allows us to smooth out the peaks and valleys of commodity cycles for our own operations and for our clients. This isn't a theoretical model; it's a practical strategy that has allowed us to offer more stable pricing and reliable delivery schedules, even during periods of extreme market turbulence. For our partners, this translates into a more predictable and dependable supply chain.

For a manufacturer in the stainless steel industry, being at the mercy of volatile input costs is a direct threat to profitability and long-term stability. The traditional model of simply buying materials, processing them, and passing on the costs is no longer sufficient in today's dynamic global market. A more sophisticated and resilient approach is required. This involves taking deliberate control of the supply chain, relentlessly pursuing operational efficiency through technology, and fostering a culture of innovation that can adapt to changing material landscapes. These three pillars—integration, technology, and innovation—are the cornerstones of a modern manufacturing strategy designed not just to survive, but to thrive amidst volatility.

Strategic Sourcing and Supply Chain Integration

One of the most powerful strategies to mitigate price fluctuations5 is to move up the supply chain. A manufacturer that relies solely on the spot market for its raw materials is completely exposed to price volatility. By contrast, a vertically integrated company can achieve greater control and foresight. At MFY, our business model is built on this principle. Our operations span from stainless steel raw material trading directly with mills to our own cold-rolled processing and tube manufacturing. This integration gives us several distinct advantages. Firstly, it provides us with deep market intelligence. Our trading division has a real-time pulse on global supply, demand, and pricing trends, which informs our own production and purchasing decisions.

Secondly, it allows for strategic procurement. Instead of buying based on immediate production needs, we can make larger, long-term raw material purchases when market conditions are favorable, effectively hedging against future price increases. This creates a buffer that insulates our production costs from short-term market spikes. For instance, by forecasting a rise in nickel prices, we can secure our coil inventory for the upcoming quarter at a lower cost, ensuring that the pipes we produce will be more competitively priced than those from manufacturers who must buy their raw materials at the new, higher spot price.

Lastly, this integration enhances supply security. By having strong relationships with a diverse portfolio of raw material suppliers and maintaining a robust inventory, we can guarantee a consistent supply of materials to our production lines, even when the market is tight. For our clients—the engineering contractors and distributors—this translates into reliability. They know that our delivery schedules are less likely to be derailed by a sudden material shortage, which is a crucial factor in their own project planning and risk management.

Investment in Technology and Operational Efficiency

The second pillar of mitigation is an unwavering focus on operational efficiency, driven by technology. As we've discussed, energy is a massive and volatile cost. A manufacturer's ability to control its energy consumption per ton of steel is a direct lever on its profitability. This is where strategic capital investment pays enormous dividends. Modernizing production equipment can lead to dramatic reductions in energy usage. For example, replacing an old annealing furnace with a new one featuring regenerative burners can cut natural gas consumption by up to 30-40%. Similarly, investing in variable frequency drives (VFDs) for the large motors that power rolling mills and pumps allows their speed to be precisely controlled, saving significant amounts of electricity compared to running them at full power all the time.

Beyond equipment, digital innovation plays a critical role. MFY has an in-house software development arm6, a unique asset for a steel company. We develop and implement proprietary manufacturing execution systems (MES) that track every aspect of production in real-time. This system monitors energy consumption, machine uptime, production yields, and scrap rates. By analyzing this data, our plant managers can identify inefficiencies that would otherwise be invisible. For example, the data might reveal that a particular machine setting leads to a higher scrap rate, which not only wastes material but also the energy that was used to process it.

This relentless pursuit of efficiency directly benefits our customers. A lower scrap rate means we are not pricing wasted material and energy into our products. Lower energy consumption per ton gives us a more competitive base price. This commitment to technology ensures that our clients are paying for high-quality, efficiently produced pipe, not for our operational inefficiencies. It is a tangible competitive differentiator in a price-sensitive market.

Product Innovation and Material Science

The third, and perhaps most forward-looking, strategy is to innovate at the product level. This involves leveraging material science to offer customers alternative solutions that may be less susceptible to the volatility of specific commodities like nickel or molybdenum. While the 300-series austenitic grades are popular, they are not always the most cost-effective solution for every application. Our R&D efforts are focused on both improving our existing products and exploring the potential of alternative materials.

For instance, duplex stainless steels, which have a mixed austenitic-ferritic microstructure, offer superior strength and excellent corrosion resistance, often comparable to or better than 316L, but with a significantly lower nickel content. For the right application, such as in structural components for bridges or in certain types of process tanks, switching from a 316L pipe to a 2205 duplex pipe can offer substantial cost savings without compromising performance. Part of our role as a solutions provider is to educate our clients on these possibilities.

This involves a consultative approach. When a client comes to us with a requirement for a large quantity of nickel-heavy pipe, our technical team will work with them to understand the precise operational environment. If the analysis shows that a leaner duplex grade would meet or exceed all performance specifications, we present it as a viable, cost-effective alternative. This not only helps the client manage their budget but also builds a deeper, more trusted partnership. It demonstrates that our goal is not simply to sell the most expensive product, but to provide the optimal solution for their specific needs, thereby helping them navigate the volatile commodity landscape through smarter material selection.

Vertical integration reduces price volatilityПравда

By controlling more stages of the supply chain, manufacturers gain better cost visibility and purchasing power to mitigate raw material price swings.

Energy efficiency only impacts sustainabilityЛожь

Energy efficiency directly reduces operational costs and provides a buffer against energy price fluctuations, making it both an economic and environmental strategy.

What are the best strategies for procurement in fluctuating market conditions?

As a procurement professional, are you tired of being surprised by price hikes and struggling to maintain your budget in a volatile market? Simply chasing the lowest price is a losing game. A strategic shift in your procurement approach is needed to succeed.

The best procurement strategies in a fluctuating market involve moving beyond transactional purchasing to build deep partnerships with transparent suppliers, utilizing flexible purchasing models like forward contracts], and focusing on the Total Cost of Ownership (TCO) rather than just the initial price of the pipe.

This is the philosophy I impress upon my team and our partners at MFY. The most successful clients I work with are those who treat us not as a mere vendor, but as an extension of their team. They leverage our market intelligence and our integrated supply chain to their advantage. One such partner, an equipment integrator for the energy sector, uses blanket orders with us, allowing them to lock in a base price and draw down material as needed, with the alloy surcharge adjusted at the time of shipment. This gives them budget stability and supply assurance, two of the most valuable commodities in today's market.

In a market defined by volatility, the role of procurement must evolve from a cost-centric function to a strategic value-creation center. The old paradigm of sending out RFQs and selecting the lowest bidder is dangerously simplistic. It ignores the hidden costs of poor quality, delayed deliveries, and supply chain disruptions, all of which can dwarf any initial savings on the per-ton price. A truly effective modern procurement strategy is built on three core pillars: fostering deep, collaborative supplier partnerships; employing sophisticated and flexible purchasing techniques; and adopting a holistic view of cost that encompasses the entire lifecycle of the product, known as the Total Cost of Ownership (TCO).

Developing Strategic Partnerships with Suppliers

The single most impactful shift a procurement team can make is to move from a transactional to a partnership-based relationship with their key suppliers. A transactional relationship is adversarial by nature; it focuses on a single transaction and squeezing the most margin out of the other party. A strategic partnership, on the other hand, is collaborative. It's built on trust, transparency, and shared goals. When you view a supplier like MFY as a strategic partner, you gain access to far more than just a product; you gain access to our market intelligence, technical expertise, and supply chain capabilities.

Imagine this scenario: you need to place a large order for a project starting in six months. In a transactional model, you might wait until the last minute to get the "best price." In a partnership model, you would contact us immediately. We would sit down with you and discuss our market forecast for nickel and molybdenum. We might advise that indicators point to a price increase in the coming months. Based on this shared intelligence, you could make an informed decision to lock in your material requirements early, protecting your project from future cost overruns. This is not about us making a quick sale; it's about us helping you manage your risk.

This partnership extends to technical support and inventory management. A true partner understands your business. They might suggest a more cost-effective duplex grade for a particular application or work with you to create a customized stocking program to ensure just-in-time availability of critical components, reducing your inventory holding costs. This level of collaboration transforms the supplier from a simple cost center into a source of competitive advantage.

Flexible Procurement and Hedging Strategies

Relying on a single purchasing method, like spot buying, is inadequate in a volatile market. A strategic procurement team must utilize a diverse toolkit of purchasing models to manage risk and optimize costs. One powerful tool is the forward contract or blanket order. This involves committing to a certain volume of material over a period, often locking in the base price. The alloy surcharge is then typically applied at the time of each individual shipment. This strategy is incredibly effective for managing budget uncertainty. It removes the risk of a sudden spike in the mill's base price, allowing for more accurate long-term financial planning.

Another strategy is active market timing based on index monitoring. Sophisticated buyers don't just wait for quotes; they actively track the commodity markets themselves. By monitoring the LME for nickel and market prices for molybdenum, they can identify historical highs and lows. They can then time their larger, non-urgent purchases to coincide with market dips. This requires a close relationship with a responsive supplier who can execute orders quickly when the price is right. At MFY, our integrated model with strong inventory and rapid export delivery capabilities is designed to support exactly this type of agile procurement.

For very large or critical projects, more advanced hedging strategies, sometimes involving financial instruments, can be considered, though this is typically reserved for the largest consumers. For most manufacturers, contractors, and distributors, the combination of forward contracts and informed market timing provides a robust framework for navigating price fluctuations without taking on excessive risk.

Emphasizing Total Cost of Ownership (TCO) over Upfront Price

The ultimate mark of a sophisticated procurement strategy is the focus on Total Cost of Ownership (TCO), not just the initial purchase price. The price on the invoice is only one part of the story. A cheaper pipe from an unreliable supplier can end up costing you far more in the long run. TCO analysis forces you to consider all the associated costs over the product's lifecycle.

Consider this comparison of two suppliers for a critical project:

| Фактор стоимости | Supplier A (Low Price) | Supplier B (Strategic Partner, e.g., MFY) |

|---|---|---|

| Upfront Pipe Cost | $95,000 | $100,000 |

| Material Quality | Inconsistent, requires on-site testing. | Certified, reliable quality. |

| Cost of Testing | $3,000 | $0 |

| Доставка | Arrives 2 weeks late. | On time, as promised. |

| Cost of Project Delay | $10,000 in labor/equipment standby. | $0 |

| Scrap/Rework Rate | 5% due to poor dimensional tolerance. | <1% due to precision manufacturing. |

| Cost of Waste | $4,750 | $1,000 |

| Total Cost | $112,750 | $101,000 |

As the table clearly shows, the "cheaper" supplier ended up costing over 11% more. This doesn't even account for the reputational damage caused by project delays. A TCO mindset understands that reliability, quality, and on-time delivery are not "soft" benefits; they are hard-dollar economic values. When you partner with a supplier like MFY, you are investing in our fully integrated supply chain, our strong production capacity, and our proven record of rapid export delivery. These strengths directly lower your TCO by reducing the risk of costly delays, quality issues, and supply chain disruptions.

Strategic partnerships reduce procurement risksПравда

Deep supplier partnerships provide market intelligence and stability that transactional relationships cannot offer.

Spot buying is best for volatile marketsЛожь

Relying solely on spot buying ignores risk management tools like forward contracts that stabilize costs.

Заключение

Ultimately, mastering stainless steel pipe procurement requires understanding that prices are driven by nickel, molybdenum, and energy costs. Navigating this volatility is best achieved by moving beyond transactional buys and partnering with a transparent, integrated supplier like MFY to build a truly resilient supply chain.

-

Understand how EV battery demand impacts the nickel market and stainless steel costs ↩

-

Explore the industries utilizing 'moly' grades for their demanding applications and environments. ↩

-

Understand the method to quantify corrosion resistance in stainless steels, emphasizing molybdenum's role. ↩

-

Discover factors affecting energy markets that impact stainless steel manufacturing costs ↩

-

Discover the benefits of supply chain integration in stabilizing manufacturing costs ↩

-

Understand the impact of technology on improving efficiency and reducing costs in steel manufacturing ↩

У вас есть вопросы или нужна дополнительная информация?

Свяжитесь с нами, чтобы получить индивидуальную помощь и квалифицированный совет.