Коды ТН ВЭД и импортные пошлины для труб из нержавеющей стали: Руководство для ведущих рынков

Navigating international trade can feel like a minefield. You've sourced the perfect stainless steel tubes, but suddenly your shipment is stuck at the port, bogged down by confusing codes and unexpected duties that are eating into your profits. This uncertainty can cripple your project timelines and budget.

The Harmonized System (HS) code is a globally recognized standard used by customs authorities to classify products. For stainless steel tubes, getting this code right is critical for determining the correct import duties, taxes, and any applicable trade restrictions, ensuring a smooth customs clearance process.

As the Global Business Director for MFY, I’ve seen firsthand how a simple string of numbers can make or break a deal. These codes aren’t just administrative hurdles; they are the language of global trade. Understanding this language is the first step toward building a resilient and efficient international supply chain. The complexities, especially with anti-dumping and countervailing duties1, require more than just a quick search; they demand a strategic approach.

This isn't just about avoiding penalties. It's about unlocking strategic advantages. A deep understanding of HS codes and tariff landscapes can reveal opportunities to optimize costs and streamline logistics, turning a potential liability into a competitive edge. However, this requires a critical look at the data, policies, and on-the-ground realities of your target markets. For instance, while a Free Trade Agreement might promise zero tariffs, does your documentation meet the stringent requirements to qualify? Relying on surface-level information is a recipe for disaster. At MFY, we believe in arming our partners with the in-depth knowledge needed to navigate these complexities, ensuring that every shipment is not just a transaction, but a successful step in their business growth.

What are HS codes and why are they important for stainless steel tubes?

Your container of high-grade stainless steel tubes has arrived, but it’s flagged by customs. The problem? A single digit is off in the HS code. Now you're facing costly delays, potential fines, and a customer whose project is on hold. It’s a frustrating and entirely avoidable situation.

An HS code is a standardized numerical method of classifying traded products used by customs worldwide to identify goods when assessing duties and taxes. For stainless steel tubes, a precise HS code ensures accurate tariff application, prevents costly delays, and guarantees regulatory compliance during international shipment.

I recall a situation with a new client, an engineering contractor in Southeast Asia. They had previously sourced from a trader who misclassified a shipment of welded 304-grade tubes. The shipment was held for weeks, incurring significant demurrage charges and jeopardizing their project deadline. When they came to us at MFY, their primary concern wasn't just price, but reliability. They needed a partner who understood that getting the details right—especially the customs classification—was paramount. This experience highlighted a crucial lesson: in international trade, expertise in logistics and compliance is just as vital as the quality of the product itself. Failing to appreciate the importance of an accurate HS code is like building a state-of-the-art facility on a faulty foundation. It’s not a matter of если it will cause problems, but when. We work with our clients to ensure this foundation is solid from the very beginning.

The Harmonized System nomenclature is a global standard, but its application has critical national nuances. For importers and exporters of industrial goods like stainless steel tubes, mastering this system isn't just an administrative task; it's a core component of business strategy. An incorrect code can lead to overpayment of duties, or worse, underpayment, which can trigger audits, severe financial penalties, and the seizure of goods. For a product like stainless steel tubes, where specifications for grade, dimension, and manufacturing process (seamless vs. welded) create dozens of potential classifications, the risk of error is substantial. This complexity is why we, as a manufacturer and exporter, integrate customs compliance deep within our sales and logistics processes. We don't just sell steel; we deliver a complete, compliant solution, ensuring that the product's journey from our mill to the client's site is as seamless as the high-quality tubes we produce. This proactive approach demystifies the customs process for our partners, transforming a potential bottleneck into a smooth, predictable part of their supply chain.

The Anatomy of an HS Code for Steel Tubes

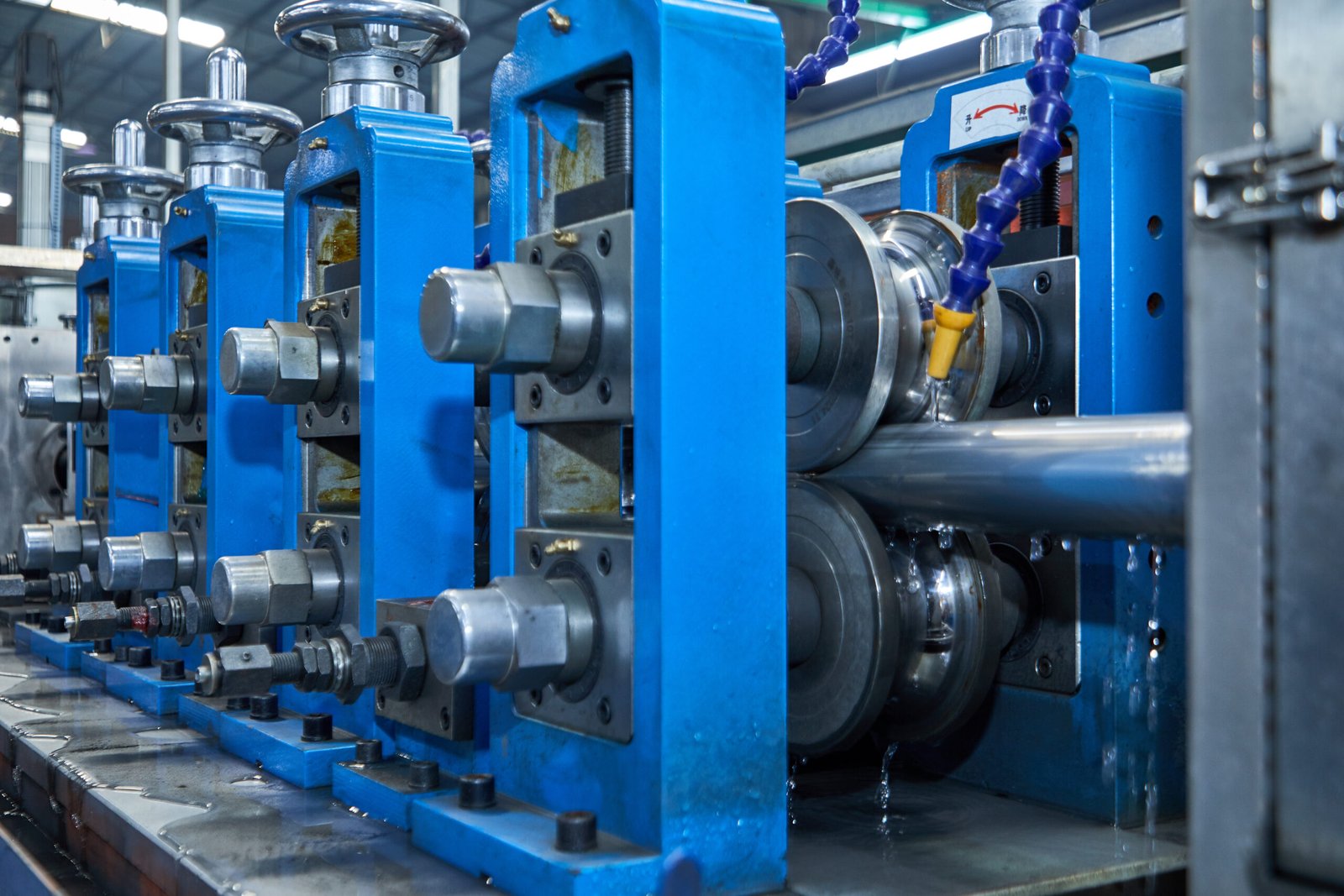

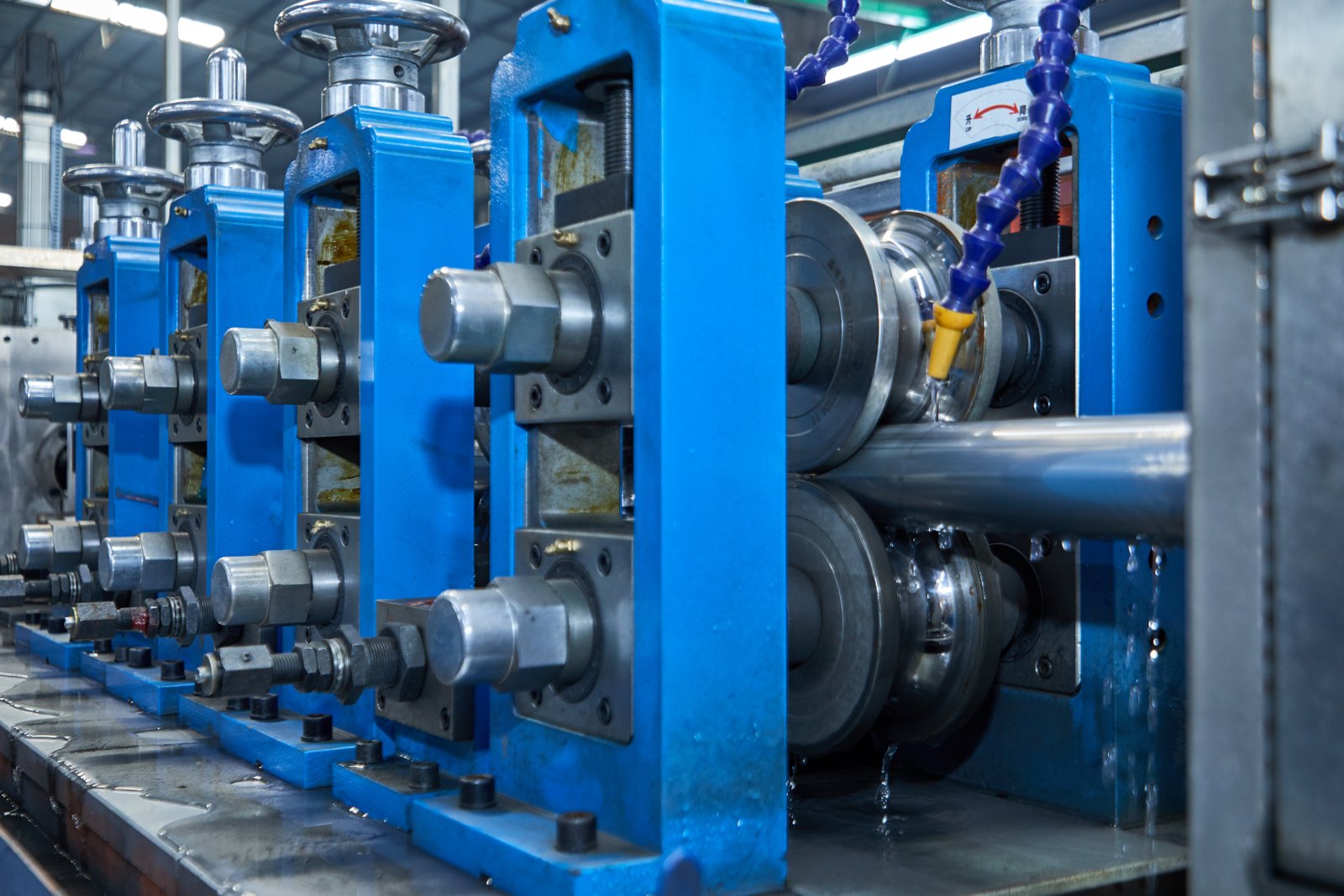

At first glance, an HS code seems like a random sequence of numbers. However, it's a highly structured hierarchy. The code is broken down into chapters, headings, and subheadings. For all stainless steel tubes, the journey begins in Chapter 73: "Articles of Iron or Steel." From there, the path diverges. Seamless tubes fall under heading 7304, while welded tubes are classified under 7306. The subsequent digits further refine the classification based on factors like material subtype (e.g., stainless steel), specific use (e.g., line pipe for oil and gas), and even physical dimensions or finishing (e.g., cold-drawn).

For example, a common code for welded stainless steel tubes of circular cross-section is 7306.40. A seamless tube of a similar type might be 7304.41. The distinction seems minor, but it can have major implications for duty rates and regulatory requirements in the destination country. Understanding this structure is the first line of defense against misclassification. It allows you to ask the right questions and provide your logistics partners with the precise technical details they need.

At MFY, we ensure that our product specifications on all commercial documents are meticulously detailed to support the chosen HS code. This isn't just about listing a product name; it's about providing the technical data—like the exact grade of stainless steel (e.g., 316L), the precise outer diameter and wall thickness, and the manufacturing standard (e.g., ASTM A312)—that substantiates the classification. This level of detail leaves no room for ambiguity at the port of entry.

From Global Standard to National Nuance

The first six digits of an HS code are internationally standardized under the World Customs Organization's convention. This means that a seamless stainless steel tube under code 7304.41 is recognized as such in nearly every country. However, individual countries can add their own 2- to 4-digit suffixes for more detailed statistical tracking or to apply specific national tariffs. This is where a significant layer of complexity arises.

A country might use a national subheading to differentiate between tubes for the automotive industry versus those for construction, applying different duty rates to each. A prime example is India, which uses an 8-digit system (the ITC-HS Code). Failing to correctly identify and apply this national-level code can mean your shipment documentation is rejected upon arrival, even if the first six digits were correct.

This is why relying on a generic "stainless steel tube" HS code is so risky. We had a case with a distributor in the Middle East who was accustomed to a single code for all their tube imports. When a new anti-dumping regulation was introduced that targeted a specific 8-digit code, their usual declaration became non-compliant overnight. Because we maintain a dynamic database of tariff codes for our key markets, we were able to flag this change proactively and adjust the classification for their next order, saving them from a costly customs entanglement.

The Real Cost of a Classification Error

The most immediate consequence of an incorrect HS code is a financial one, but the damage often runs much deeper. It’s not just about paying the wrong duty; it’s about the cascade of problems that follows. Delays at the port lead to demurrage and detention charges, which can accumulate rapidly. Your customer's manufacturing or construction schedule is disrupted, damaging your reputation and potentially leading to contractual penalties. Furthermore, customs authorities may flag your company for increased scrutiny on all future shipments.

To illustrate, let's consider a hypothetical shipment of stainless steel tubes valued at $100,000 to India. The correct classification might have a 7.5% basic customs duty plus a 15% anti-dumping duty (ADD). An incorrect, but similar-looking, code might only have the 7.5% duty. The temptation to use the lower-duty code is obvious, but the risks are immense.

| Consequence | Scenario A: Correct HS Code (7306.40.XX) | Scenario B: Incorrect HS Code (7306.90.XX) |

|---|---|---|

| Declared Duty | $22,500 (7.5% BCD + 15% ADD) | $7,500 (7.5% BCD only) |

| Customs Finding | Cleared | Misclassification Detected |

| Duty Adjustment | N/A | $15,000 Underpayment Due |

| Penalty (Typical) | N/A | $15,000 (100% of duty evaded) |

| Shipment Delay | 2-3 Days | 20-30 Days |

| Demurrage/Detention | ~$100 | ~$3,000 |

| Total Extra Cost | $0 | ~$33,000 |

As the table demonstrates, a mistake made to save $15,000 can ultimately cost more than double that amount, not to mention the intangible damage to client relationships and business reputation. This is why at MFY, our export team is trained to view HS classification not as paperwork, but as a critical risk management function.

HS codes determine import dutiesПравда

HS codes are used by customs authorities worldwide to classify products and calculate applicable duties and taxes.

All countries use identical HS codesЛожь

While the first 6 digits are standardized, countries often add 2-4 digit suffixes for national tariff variations.

How do HS codes and import duties currently affect stainless steel tubes in top markets?

You've secured a major contract in a key export market, but the landscape of tariffs and duties feels like quicksand. One country has anti-dumping duties, another offers preferential rates under an FTA, and a third just announced a new tariff. This volatility threatens your profitability and supply chain stability.

In top markets like India, Southeast Asia, and the Middle East, HS codes directly determine the application of high import duties, including significant anti-dumping and countervailing duties specifically targeting stainless steel tubes, creating a complex and varied cost landscape for importers.

Understanding these market-specific nuances is fundamental to our work at MFY. It's not enough to know the general HS code for a product. You must know how that code is treated in Delhi, Ho Chi Minh City, or Dubai2. For example, exporting to Vietnam can be highly advantageous if your products qualify under the ASEAN-China Free Trade Area (ACFTA), potentially reducing tariffs to zero. However, failing to provide the correct Certificate of Origin and other documentation means you'll face the standard, much higher, MFN (Most Favored Nation) rate, plus potential countervailing duties. This isn't just a theoretical risk; it’s a practical challenge we help our partners navigate every day, ensuring they can leverage trade agreements effectively rather than being penalized by them. This requires a proactive, intelligence-led approach to foreign trade.

The global trade environment for steel products is anything but static. It's an arena where economic policy, geopolitical relationships, and domestic industry protectionism collide. For a business importing stainless steel tubes, this means that the duty rate applicable today may not be the same one in effect six months from now. The rise of trade remedies—specifically anti-dumping (AD) and countervailing duties (CVD)—has become the single most significant factor influencing import costs. These are not standard tariffs; they are targeted measures, often aimed at specific countries and even specific manufacturers, and can add anywhere from 20% to over 200% to the cost of goods. Navigating this requires constant vigilance and deep market intelligence. At MFY, our integrated model, which combines manufacturing with a dedicated export trade division, allows us to maintain this vigilance. We are not passive observers; we are active participants in the global supply chain, which gives us real-time insight into the shifting regulatory currents and enables us to guide our clients with confidence.

The Indian Fortress: Navigating Anti-Dumping and Countervailing Duties

India stands out as a market with a robust and actively enforced trade defense mechanism. For Chinese exporters of stainless steel tubes, this translates into a multi-layered tariff structure. Beyond the basic customs duty (BCD), importers frequently face both Anti-Dumping Duties (ADD) and Countervailing Duties (CVD). These duties are the result of investigations by India's Directorate General of Trade Remedies (DGTR), which often concludes that products are being sold below fair market value (dumping) or benefit from government subsidies in their country of origin.

In a recent, significant development, India extended the countervailing duty on certain welded stainless steel pipes and tubes from China. This means that on top of all other applicable taxes, an additional percentage is levied to offset the perceived subsidy. The rates can be substantial and are often producer-specific, meaning MFY might face a different rate than another Chinese manufacturer. This complexity makes it impossible for an importer to calculate their final costs without precise information from the supplier.

I worked with a large Indian distributor who was considering switching suppliers. Their previous partner had provided incorrect information about the applicable ADD, leading to a massive, unexpected tax bill that wiped out their margin on the entire project. In our proposal, we didn't just provide a price for the tubes; we provided a transparent breakdown of the costs, including a clear statement on the specific ADD and CVD our products would attract based on the correct HS code. This transparency built immediate trust and demonstrated that we understood their market's unique challenges.

Southeast Asia's Double-Edged Sword: FTAs vs. Trade Barriers

Southeast Asia, particularly markets like Vietnam, presents a fascinating duality. On one hand, it is a region ripe with opportunity, driven by strong manufacturing growth. On the other, it has its own set of protectionist measures. Vietnam, for instance, has imposed its own countervailing duties on welded stainless steel tubes from certain countries, including China. An importer unfamiliar with these regulations could be in for a nasty surprise.

However, the game-changer for this region is the prevalence of Free Trade Agreements (FTAs), chiefly the ASEAN-China Free Trade Area (ACFTA)3 and the Regional Comprehensive Economic Partnership (RCEP). These agreements can reduce import duties to zero for qualifying goods. The critical word here is qualifying. To benefit from a 0% tariff, an importer must present a valid Certificate of Origin (Form E for ACFTA) that proves the goods were manufactured in a member country according to strict "rules of origin."

This creates a clear strategic choice. A business can source from the cheapest supplier, who may not be able to provide the correct FTA documentation, and end up paying a 20-30% duty. Or, they can partner with a compliant manufacturer like MFY, who understands the documentation process inside and out. We ensure every export eligible for FTA benefits is accompanied by flawless paperwork, turning a potential 30% barrier into a 0% advantage for our clients. It’s a classic case of the sticker price not telling the whole story.

New Tariffs in the Middle East: The Saudi Precedent and Regional Risk

The Middle East has traditionally been a more open market with lower standard tariffs. However, recent developments signal a significant shift. In mid-2025, Saudi Arabia imposed definitive anti-dumping duties on welded stainless steel pipes and tubes from China and Taiwan. These duties are not insignificant, ranging from around 6.5% to over 24% depending on the exporter.

This move is critically important not just for exporters to Saudi Arabia, but for anyone trading in the Gulf Cooperation Council (GCC) region, which includes the UAE, Qatar, Bahrain, Kuwait, and Oman. The GCC countries often coordinate their trade and economic policies. The Saudi action could be a leading indicator, creating a precedent for other GCC nations to follow suit with similar investigations and tariffs if they perceive a threat to their own nascent domestic industries.

For our clients, who include major engineering and construction contractors in Dubai and Abu Dhabi, this development immediately went on our risk radar. We proactively informed them of the Saudi duties, advising them to factor in a potential risk of similar measures in the UAE for future projects. This kind of forward-looking analysis allows our partners to budget more accurately and avoid being caught off-guard. It demonstrates our role as more than just a supplier; we are a strategic partner invested in protecting our clients' commercial interests in a dynamic global environment.

HS codes determine import dutiesПравда

HS codes are the primary classification system that customs authorities use to apply specific tariff rates and trade measures like anti-dumping duties.

FTAs eliminate all import costsЛожь

Free Trade Agreements only reduce tariffs for qualifying goods with proper documentation; other fees like VAT or processing charges may still apply.

What challenges do businesses face when dealing with import duties on stainless steel tubes?

You've done your research and you think you understand the costs, but then a customs agent reclassifies your product. Or a new, unannounced tariff is retroactively applied. These unpredictable events create massive operational headaches and financial uncertainty, making it hard to plan and execute projects reliably.

Businesses face significant challenges including the intricate task of accurately classifying diverse stainless steel tubes, navigating the volatility of frequently changing trade tariffs and anti-dumping duties, and managing the burdensome documentation required to prove compliance or qualify for preferential treatment.

This is a constant battle of details. A few years ago, we were shipping to a manufacturing client in India. The product was a specific grade of seamless tube used in heat exchangers. The client's broker was used to clearing a more common grade of tube and used a familiar, but incorrect, HS code. The result was a customs query that delayed the shipment by over a month. The challenge wasn't a lack of knowledge, but a lack of specific knowledge for that particular product. This incident was a catalyst for us to develop our "compliance-first" shipping protocol, where we work with the client and their broker до shipment to agree on the precise HS code and required documentation, preventing these issues before they start. It’s about collaboration to de-risk the entire process.

The core of the problem lies in the gap between the perceived simplicity of a product and the actual complexity of its trade classification. A stainless steel tube is not just a tube. It is a product defined by a dozen critical attributes: its manufacturing process (welded or seamless), its alloy composition (304, 316L, Duplex), its precise dimensions, its surface finish, and its intended application. Each of these attributes can be a determining factor in its HS classification, and therefore, the duty it attracts. The challenge for businesses is that this level of technical detail is often lost in translation between the engineering department, the procurement team, and the logistics provider. This communication gap is where errors, delays, and costs are born. At MFY, our integrated structure is our biggest strength in closing this gap. Our sales and export teams have deep product knowledge, allowing them to act as a bridge, ensuring that the technical reality of the product is perfectly reflected in the trade documentation.

The Labyrinth of Product Specification and Classification

The Harmonized System is designed to be specific, and that specificity is a major challenge. For stainless steel tubes, the classification can change based on what may seem like minor technical differences. For instance, is the tube welded (HS 7306) or seamless (HS 7304)? Is it of circular cross-section or non-circular (e.g., square or rectangular, under HS 7306.61)? Has it been cold-drawn or cold-rolled, which can sometimes push it into a different sub-category? Answering these questions incorrectly is the most common source of customs disputes.

Consider a construction contractor in the UAE building a high-end architectural project. They need polished, rectangular stainless steel tubes for a facade. The procurement manager, focusing on the material "stainless steel tube," might use a general code they've used before for round piping. However, customs will identify the product as "welded, of non-circular cross-section, of stainless steel," which falls under a very specific code: 7306.61.10. If the declared code and the actual product don't match, the shipment is immediately flagged.

This isn't malicious; it's a simple mismatch between the commercial description and the technical reality. The challenge is that procurement teams are focused on cost and delivery schedules, not the nuances of customs taxonomy. This is why we invest time in educating our clients' procurement staff or working directly with their customs brokers. We provide clear documentation, including Mill Test Certificates (MTCs) and detailed product specs, that directly supports the HS code we declare, creating an evidence trail that satisfies even the most stringent customs inspections.

The Ever-Shifting Sands of Global Trade Policy

The second major challenge is volatility. Basic customs duties are relatively stable, but trade remedies like anti-dumping (AD) and countervailing duties4 are not. These are political and economic tools that can be implemented, reviewed, and changed based on the trade relationship between two countries and the complaints of domestic industries. A country can launch an AD investigation, and within months, impose a provisional duty that dramatically alters import costs.

This creates tremendous uncertainty. A distributor might build a business model based on a 10% total import cost, only to find that a new 40% anti-dumping duty has been imposed on their supplier. This happened recently in the Middle East with the Saudi tariffs. For years, the market was predictable. Suddenly, the landed cost of Chinese-origin tubes increased significantly overnight. Businesses that had open orders or had quoted for long-term projects based on the old cost structure were put in an incredibly difficult position.

Managing this challenge requires more than just reacting to news. It requires foresight. At MFY, we monitor trade remedy investigations in all our key markets. When we see an investigation launched in a country, we immediately alert our clients there. We provide them with information about the potential scope of the duties and help them strategize. This might involve planning future orders to potentially avoid the duty implementation date or exploring product grades that fall outside the scope of the investigation. It's about turning market intelligence into actionable, defensive strategies.

The Burden of Proof: Documentation for Preferential Treatment

While high tariffs present a challenge, so does the opportunity to avoid them. Free Trade Agreements (FTAs) like the ACFTA are a powerful tool for reducing costs, but they come with a significant administrative burden. To claim a preferential tariff rate (often 0%), an importer can't just tick a box. They must present a comprehensive set of documents that proves the goods meet the FTA's "rules of origin."

The primary document is the Certificate of Origin (CO), such as Form E for the ACFTA. This is not a simple form. It must be issued by an authorized body in the exporting country and contain information that matches the commercial invoice, packing list, and bill of lading perfectly. Any discrepancy—a typo in the consignee's name, a slight difference in the declared weight, a missing signature—can lead to the CO being rejected by the importing country's customs authority.

If the CO is rejected, the consequences are immediate. The shipment is assessed at the full, non-preferential duty rate. There is rarely a chance to correct the error after the fact. The importer must pay the higher duty to get their goods released. I have seen clients lose the entire cost advantage of an FTA due to a simple clerical error made by an inexperienced supplier. This is why we have a dedicated team at MFY that handles all trade documentation. They are experts in the specific requirements of each FTA and each destination country, ensuring a 99.9% acceptance rate for our Certificates of Origin. This meticulous attention to detail is a quiet but critical part of the value we deliver.

HS codes vary by tube manufacturing methodПравда

Seamless tubes (HS 7304) and welded tubes (HS 7306) have different classifications under the Harmonized System.

Anti-dumping duties remain stable for yearsЛожь

Anti-dumping duties can change suddenly based on trade investigations, as seen with Saudi tariffs on Chinese tubes.

What strategies can businesses use to effectively manage import duties for stainless steel tubes?

Feeling trapped by volatile tariffs and complex regulations can be paralyzing. You want to grow your business internationally, but the financial risks associated with import duties feel like a gamble you can't afford to lose. You need a clear, reliable path forward to manage costs and ensure predictability.

To manage duties effectively, businesses should conduct pre-shipment HS code and tariff audits, strategically leverage Free Trade Agreements by ensuring strict documentation compliance, and cultivate a partnership with a knowledgeable supplier who provides transparent and proactive guidance on trade regulations.

This shifts the dynamic from reactive problem-solving to proactive cost management. As a strategy, we at MFY don't wait for our clients to ask about duties; we bring the conversation to them at the quotation stage. For a client in Vietnam, for example, we'll present two cost scenarios: the landed cost with standard duties, and the significantly lower cost achievable by using the ACFTA. We then outline the exact steps and documentation we will manage to ensure they secure that lower cost. This isn't just a sales tactic; it's a core part of our service. It empowers our clients to make fully informed purchasing decisions and transforms the complex world of import duties from a threat into a strategic opportunity.

Effective management of import duties is not a one-off task but an ongoing business process that must be embedded into your procurement and logistics functions. The goal is to create a system that minimizes surprises and maximizes control. This requires a fundamental shift in how you view your supplier. A transactional relationship, where the supplier's responsibility ends at the port of loading, is no longer sufficient in today's trade environment. You need a strategic partner who sees their role as extending all the way to your final customs clearance. This partnership should be built on three pillars: forensic-level attention to detail in classification, deep expertise in leveraging trade agreements, and transparent communication about market risks and opportunities. This holistic approach is what transforms the customs process from a necessary evil into a source of competitive advantage. It ensures you are not just buying a product, but a predictable, optimized, and resilient supply chain solution.

Proactive Tariff Engineering: Pre-Classification and Audits

The most effective strategy is to address potential problems before they exist. This begins with "tariff engineering," which involves a comprehensive review and confirmation of the HS code for your products long before any shipment is booked. This isn't a job for an intern with a search engine. It should involve your supplier's technical team, your logistics provider, and a customs broker in the destination country. The goal is to create a consensus on the correct classification based on detailed product specifications.

Once a code is determined, the next step is a tariff audit. This means verifying the exact duties—basic, ADD, CVD, VAT, etc.—that apply to that specific HS code from that specific country of origin. This should never be assumed. At MFY, we maintain our own internal database of tariffs for our key export markets, but we still advocate for a "trust but verify" approach. We encourage our clients to get a binding ruling from their local customs authority if there is any ambiguity.

I worked with a major equipment integrator who was planning a new product line that required a large volume of specialized stainless steel tubes. Before they placed a single order, we collaborated with them for a month. We analyzed the technical drawings, confirmed the HS code with brokers in both the EU and the US (their target markets), and provided a detailed report on the full landed cost for each region. This proactive work allowed them to budget with near-perfect accuracy and completely eliminated the risk of customs-related financial surprises down the line.

Mastering Free Trade Agreements: From Paperwork to Profit

Free Trade Agreements are the single most powerful tool for reducing import duties, yet they are widely underutilized due to their perceived complexity. The strategy here is not just to be aware of FTAs, but to master the execution required to benefit from them. This is a process-driven strategy that requires flawless execution on the documentation front.

The first step is eligibility. The supplier must be in a member country, and the product must meet the specific "rules of origin." For stainless steel tubes, this often involves a "change in tariff classification" test or a "regional value content" test. A knowledgeable supplier like MFY will already know if their products qualify and can provide the necessary proof. The second step is documentation. This means ensuring the Certificate of Origin (e.g., Form E for ACFTA) is generated correctly, is free of any errors, and perfectly matches all other shipping documents (commercial invoice, bill of lading).

To make this concrete, let's look at a shipment to Vietnam. The standard duty on our tubes might be 10%, with an additional 15% CVD, for a total of 25%. On a $200,000 order, that's a $50,000 tax bill. By correctly leveraging the ACFTA, the duty becomes 0%. The entire strategy rests on our ability to provide a perfect Form E. Our internal process includes a multi-point check of all documents before they are submitted to the issuing authority and sent to the client. This operational excellence is what turns a 25% tariff into a 0% tariff, directly adding $50,000 to our client's bottom line.

The Strategic Supplier Partnership: More Than Just a Transaction

Ultimately, the most resilient strategy is to choose the right partners. In the context of importing industrial goods, your primary manufacturing supplier should also be your first line of defense in managing duties. A purely transactional supplier who provides a low ex-works price but offers no support on logistics and compliance is a massive liability in the current trade climate. You need a partner who has skin in the game.

What does this look like in practice? It means choosing a supplier with a fully integrated supply chain and a dedicated, expert export team. It means they should be able to provide you with clear, accurate information on HS codes and potential duties for your market as part of their initial quotation. They should have a proven track record of successful FTA documentation. And they should proactively inform you of changes in trade policy that could affect your business.

This is the philosophy that underpins our vision at MFY. Our competitive strengths—our integrated supply chain, strong production capacity, and innovation-driven approach—are all geared towards this goal. We don't just sell steel tubes. We provide our clients—from manufacturing companies to engineering contractors—with a stable, predictable, and optimized supply channel. We manage the complexities of global trade so they can focus on what they do best: building, creating, and growing their own businesses. This partnership transforms import management from a defensive chore into a shared, offensive strategy for success.

HS code audits reduce duty surprisesПравда

Pre-shipment HS code verification with technical teams and customs brokers ensures accurate duty calculations before orders are placed.

FTAs automatically lower all tariffsЛожь

FTAs require strict compliance with rules of origin and perfect documentation (like Form E) to qualify for reduced tariffs.

What technical suggestions can streamline compliance with HS codes for stainless steel tubes?

You're trying to ensure compliance, but your team is drowning in paperwork. Product specifications, commercial invoices, and packing lists all need to match perfectly with a complex HS code, and any small error can cause a major delay. The manual process is slow, prone to error, and creates constant anxiety.

To streamline compliance, create a centralized internal database linking every product SKU to a verified HS code, ensure all commercial documents are hyper-detailed and consistent, and leverage trade management software to automate checks and stay updated on global tariff changes.

This is about systemizing expertise. We had a client, a large distributor with hundreds of SKUs for stainless steel tubes, who struggled with inconsistent classifications across different orders and staff members. We worked with them to build a simple "HS Code Bible." For each product they buy from us, we provided the verified 8-digit HS code for their country, along with the key technical specs that justify it. This simple tool eliminated ambiguity and ensured anyone on their team could process a new order with confidence, ensuring consistency and dramatically reducing errors. It’s a technical solution to a human process problem.

The quest for streamlined compliance is a journey from manual, ad-hoc processes to a systematic, technology-enabled framework. The underlying principle is to create a "single source of truth" for all trade-related data within your organization and to ensure that this truth is reflected with perfect consistency across all external-facing documentation. This requires discipline and an upfront investment in process design, but the payoff is immense. It reduces the risk of human error, speeds up the customs clearance process, and frees up your team's time to focus on more strategic activities than firefighting customs issues. For a product as technically nuanced as stainless steel tubes, this technical rigor isn't optional; it is the very foundation of an efficient and resilient international supply chain. Integrating these technical suggestions moves a business from a state of constant vulnerability to one of control and predictability.

Building Your Internal HS Code Bible

The first and most impactful technical step is to stop treating HS classification as a one-time task for each shipment. Instead, create a centralized, internal database—your "HS Code Bible." This can be as simple as a shared spreadsheet or as sophisticated as a module within your ERP system5. The critical function is that it maps every single product you import to a pre-verified, full-length HS code for each destination country.

For each entry, you should store not just the code, but the justification for it. For a stainless steel tube, this means listing the key technical attributes: Product SKU, Description (e.g., Seamless SS 316L Tube), Manufacturing Process (Seamless), Dimensions (OD x Wall Thickness), and relevant Standard (e.g., ASTM A269). By having this detailed record, you create corporate memory. It ensures that whether your lead logistics manager is on vacation or a new team member is handling the shipment, the same correct code is used every time.

As a supplier, we contribute to this by providing our regular clients with a complete list of their purchased products and our recommended, verified HS codes for their markets. This becomes the foundational data for their own internal bible. This simple act of data sharing and standardization eliminates a huge source of potential error and streamlines the entire order-to-delivery process.

The Power of Precise and Consistent Documentation

Customs authorities operate on a simple principle: consistency. The information on the commercial invoice, the packing list, the bill of lading, and the certificate of origin must align perfectly. Any discrepancy is a red flag. The most common technical failure is a vague or inconsistent product description. A commercial invoice that simply says "Stainless Steel Tubes" is an invitation for a customs inspection.

The technical solution is to enforce a strict template for all shipping documents. The product description on the invoice should be detailed and mirror the language that justifies the HS code. For example: "Seamless Stainless Steel Tubes, Grade 316L, Cold-Drawn, OD 25.4mm x WT 1.65mm, according to ASTM A269." This level of detail should be identical on the packing list. The net and gross weights must also match across all documents.

This requires close coordination with your supplier. At MFY, our export documentation team works from a single data entry source to generate all documents for a shipment. This ensures that the detailed product description, quantities, weights, and HS code are populated consistently across the invoice, packing list, and the application for the certificate of origin. This "single source of truth" approach prevents the copy-paste errors and inconsistencies that are a primary cause of customs delays.

Leveraging Technology: Introduction to Global Trade Management (GTM) Software

For businesses that import significant volumes, manual processes eventually become unsustainable. The next logical technical step is to leverage technology, specifically Global Trade Management (GTM) software6. These platforms are designed to automate and manage the complexities of international trade compliance. A GTM system can be a game-changer for streamlining HS code compliance.

First, these systems maintain an up-to-date database of HS codes and tariff rates for countries all over the world. When you enter a product and its destination, the software can suggest the correct classification and calculate the estimated landed cost, including all duties and taxes. This automates the tariff audit process and provides instant visibility into costs. Second, GTM software can screen your transactions against lists of denied parties and trade embargoes, reducing compliance risk.

Perhaps most importantly, a GTM platform can integrate with your ERP system. It can pull product information from your master data, link it to the correct HS code in its database, and use that information to automatically generate compliant shipping documents. This level of automation drastically reduces manual data entry, which in turn minimizes the risk of human error. While it represents a significant investment, for companies whose supply chains are critical to their business, the ROI in terms of risk reduction, improved efficiency, and cost savings is substantial. It is the ultimate technical solution for professionalizing a company's global trade operations.

HS codes require technical justificationПравда

For stainless steel tubes, HS codes must be supported by detailed technical specifications like material grade and manufacturing process.

Vague product descriptions speed clearanceЛожь

Customs authorities require detailed, consistent descriptions matching HS code justifications - vague descriptions trigger inspections.

Заключение

Mastering the complexities of HS codes and import duties is not merely an administrative task; it is a core business strategy. Proactive classification, leveraging FTAs, and partnering with a knowledgeable supplier are essential for building a resilient, cost-effective global supply chain for stainless steel tubes.

-

Discover the impact of these duties on international trade, including financial and competitive implications ↩

-

Learn how HS code application varies in key cities ↩

-

Discover duty-saving opportunities under ACFTA for qualifying products ↩

-

Understand countervailing duties and their effect on import pricing of steel products. ↩

-

Discover how ERP systems facilitate better HS code management and data integration for trade. ↩

-

Explore the advantages GTM software offers for efficient international trade compliance. ↩

У вас есть вопросы или нужна дополнительная информация?

Свяжитесь с нами, чтобы получить индивидуальную помощь и квалифицированный совет.