304L Stainless Steel Pipe Manufacturer for the Indian Market

Struggling to navigate India's competitive steel market? The high standards and fierce local competition can feel overwhelming. Success hinges on a clear strategy focused on quality, partnerships, and technology.

To succeed as a 304L stainless steel pipe manufacturer in India, you must focus on superior weldability, meet surging demand from infrastructure projects, overcome logistical challenges through strategic partnerships, and invest in advanced production technologies to ensure consistent quality and compliance with evolving standards.

The Indian market is not just growing; it's evolving. As Global Business Director at MFY, I've seen firsthand how this market rewards manufacturers who understand its unique demands and challenges. It's a landscape of immense opportunity for those prepared to deliver not just a product, but a comprehensive solution. In this article, I'll break down the background, demand, challenges, and winning strategies for any manufacturer looking to thrive in India's dynamic 304L stainless steel pipe sector.

What is the background of 304L stainless steel pipe manufacturing?

Understanding 304L seems complex. Its specific properties are crucial for success in demanding applications. The "L" simply stands for low carbon, which dramatically improves its performance after welding.

304L is a variant of the common 18/8 (18% chromium, 8% nickel) austenitic stainless steel. Its key feature is a maximum carbon content of 0.03%, which minimizes harmful carbide precipitation during welding, thus preserving its excellent corrosion resistance in welded structures and industrial environments.

At MFY, we often explain to clients that the choice between 304 and 304L is one of the most critical decisions in a project's design phase. While they appear similar, their performance in certain conditions is worlds apart. The primary differentiator, this low carbon content, directly addresses a major vulnerability in standard stainless steels: sensitization.

The Low Carbon Advantage

When standard 304 stainless steel is heated during welding (between 425 to 815°C), the carbon and chromium atoms can combine to form chromium carbides along the grain boundaries. This process depletes the chromium in the adjacent areas, making the steel susceptible to intergranular corrosion, especially in corrosive environments. This can lead to premature failure at the weld joints. 304L, with its restricted carbon content, significantly reduces this carbide formation. This means the welded areas remain almost as corrosion-resistant as the base metal, a non-negotiable requirement for pipelines carrying chemicals, water, or other critical fluids.

Comparing 304 vs. 304L

To put it simply, 304L is the preferred choice for any application involving significant welding. Here's a quick breakdown:

| Feature | Grade 304 Stainless Steel | Grade 304L Stainless Steel |

|---|---|---|

| Carbon Content | Up to 0.08% | Max 0.03% |

| Weldability | Good, but requires post-weld annealing | Excellent, no post-weld treatment needed |

| Corrosion Resistance | Good | Excellent, especially at weld joints |

| Primary Use | General-purpose applications | Heavily welded components, corrosive service |

Because of these properties, 304L has become the default standard for industries where reliability and longevity are paramount.

How is the current demand for 304L stainless steel pipes in the Indian market?

Unsure about India's market potential? Missing this construction and manufacturing boom could be a monumental loss. Demand is surging, driven by massive government and private sector infrastructure investment.

The demand for 304L stainless steel pipes in India is experiencing exponential growth. This surge is primarily fueled by the nation's expanding infrastructure, construction, automotive, and food processing sectors, all of which require high-quality, corrosion-resistant, and durable piping solutions.

India's ambition to become a global manufacturing hub isn't just a headline; it's a reality we see reflected in our order books every quarter. The "Make in India" initiative and massive investments in urban development are creating a perfect storm of demand for high-grade materials. I remember a conversation with a client in Pune who runs an automotive component factory. Five years ago, they used a mix of materials. Today, they exclusively specify 304L for all fluid and exhaust systems to meet higher global quality standards. This story is repeating itself across countless industries.

Key Growth Drivers

The demand isn't monolithic; it's powered by several key sectors that value the specific benefits of 304L stainless steel.

-

Infrastructure and Construction: This is the largest consumer. From new airports and smart cities to water treatment plants and desalination facilities, the need for reliable, long-lasting piping that resists corrosion is immense. 304L is the material of choice for potable water systems and architectural applications where both strength and aesthetics matter.

-

Automotive Industry: As India becomes a major auto exporter, manufacturers are adopting stricter quality controls. 304L is essential for exhaust systems, fuel lines, and structural components where weldability and resistance to high temperatures and corrosive byproducts are critical.

-

Food and Beverage Processing: Hygiene is non-negotiable in this sector. 304L's smooth surface, corrosion resistance, and inability to harbor bacteria make it the ideal material for dairy, brewery, and food processing pipelines.

This multi-sectoral demand provides a stable and expanding market for manufacturers who can consistently deliver high-quality 304L pipes.

What are the challenges faced by manufacturers in supplying 304L pipes to India?

Supplying the Indian market seems difficult. Complex logistics, stringent regulations, and intense local competition create significant hurdles. Understanding these challenges is the first step to building a resilient strategy.

Manufacturers supplying 304L pipes to India face challenges including navigating complex logistics and import duties, meeting stringent Bureau of Indian Standards (BIS) quality certifications, and competing with the aggressive pricing of a highly fragmented domestic market.

Every market has its complexities, but India's combination of scale, diversity, and regulation requires a particularly sharp approach. At MFY, we've dedicated significant resources to building a robust supply chain specifically for India because we know that overlooking these details can quickly erode margins and damage reputations. It's not enough to simply have a good product; you must have a system designed to deliver it efficiently and in full compliance.

Navigating the Obstacles

Let's break down the primary challenges manufacturers must prepare for.

-

Logistical Hurdles: India's sheer size and varied infrastructure mean that port-to-factory transportation can be unpredictable. Delays at customs, inland transit issues, and varying state-level regulations can disrupt delivery timelines. A reliable local logistics partner is not a luxury; it's a necessity.

-

Quality Standards and Compliance: The Bureau of Indian Standards (BIS) has strict certification requirements for many steel products. Obtaining and maintaining this certification requires rigorous testing and documentation. Furthermore, clients in sectors like pharmaceuticals and nuclear power have their own supplementary quality audits, adding another layer of complexity.

-

Intense Local Competition: The Indian domestic market is home to numerous steel pipe manufacturers, from large integrated mills to smaller regional players. This creates intense price pressure. Competing solely on price is a losing game. The key is to differentiate through superior quality, consistent supply, and value-added services.

| Challenge | Impact on Business | Mitigation Strategy |

|---|---|---|

| Logistics | Delayed deliveries, increased costs | Partner with experienced local logistics providers |

| Regulations (BIS) | Market access denial, legal issues | Invest in certification processes early |

| Competition | Price wars, margin erosion | Differentiate on quality and service |

What strategies can manufacturers adopt to overcome these challenges?

Facing roadblocks in the Indian market? Without a clear, proactive strategy, failure is a real possibility. The solution lies in focusing on strategic partnerships, unwavering quality, and supply chain optimization.

To overcome challenges in the Indian market, manufacturers should forge strong local partnerships for distribution and logistics, invest heavily in quality assurance to exceed BIS standards, and build a resilient, technology-driven supply chain to ensure reliable and cost-effective delivery.

A reactive approach to the Indian market is a recipe for disaster. The most successful players are those who build a framework for success before the first container ships. This is about creating a system that anticipates problems and has solutions ready. At MFY, our entire business model is built on this principle—we integrate our supply chain from raw material sourcing to final delivery, which gives us the agility to navigate market shifts.

A Blueprint for Success

Here are the core strategies that we've seen work time and again.

-

Forge Strategic Local Partnerships: You cannot succeed in India from a distance. Partnering with a reputable local distributor or agent is critical. They understand the local business culture, have established logistics networks, and can navigate the regulatory landscape far more effectively. They are your boots on the ground.

-

Invest in Quality as a Differentiator: Instead of fighting on price, make quality your battlefield. This means investing in top-tier production technology, implementing rigorous quality control at every stage, and providing comprehensive material test certificates (MTCs) with every shipment. When a client knows your product will perform flawlessly, they are willing to pay a premium for that peace of mind.

-

Build a Resilient and Transparent Supply Chain: In a market prone to disruption, resilience is key. This involves diversifying your raw material sources, maintaining strategic inventory levels, and using technology for real-time tracking and communication. I recall helping a client in Gujarat who was constantly facing production stoppages due to inconsistent raw material delivery. By integrating them into our supply chain, we provided them with predictable lead times, cutting their downtime by over 30%.

What technical advancements can enhance the production of 304L pipes for the Indian market?

Are your production methods feeling outdated? Competitors are leveraging new technology to lower costs and improve quality. Adopting modern automation and testing is non-negotiable for market leadership.

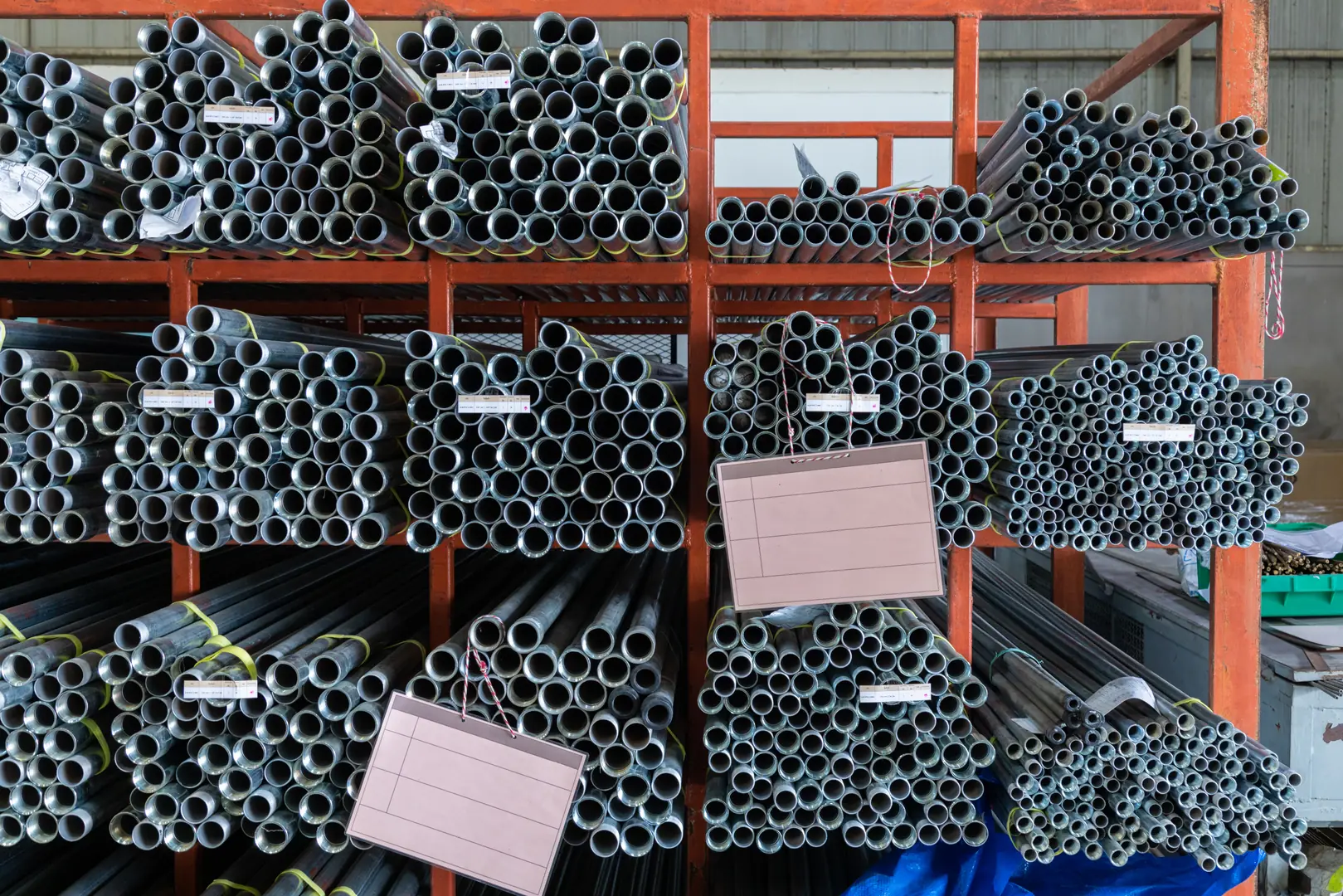

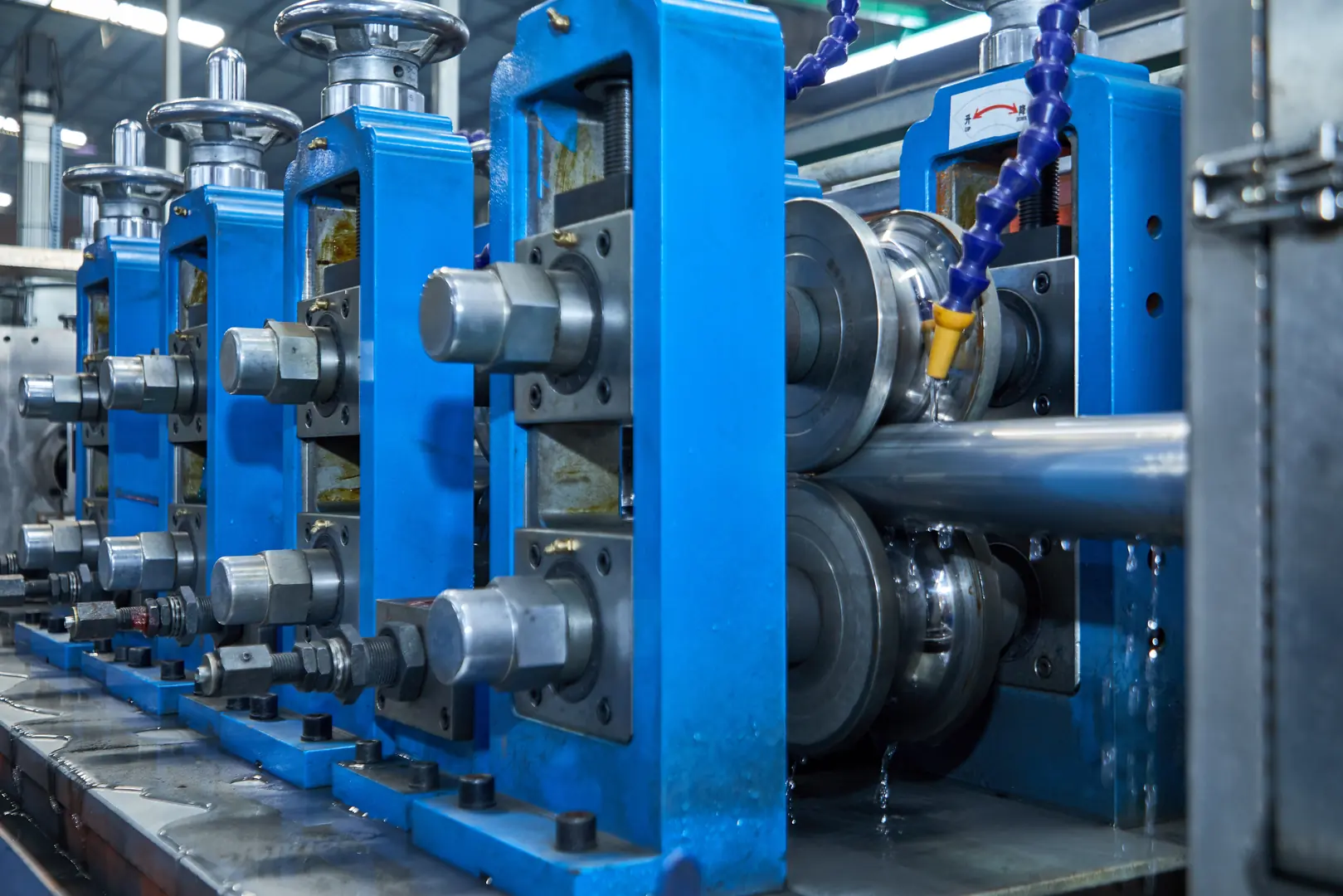

Key technical advancements for 304L pipe production include high-frequency induction (HFI) and laser welding for superior seam integrity, advanced non-destructive testing (NDT) methods like eddy current testing for quality assurance, and automation for improved dimensional accuracy and efficiency.

Technology is the great equalizer. It allows manufacturers to produce higher-quality products more consistently and at a lower cost. For a market as quality-sensitive and competitive as India, investing in the right technology is not just an operational upgrade—it's a strategic imperative. The goal is to move from simply making pipes to engineering solutions that clients can trust implicitly.

Technologies Driving the Future

Let's look at the specific advancements that are making the biggest impact.

-

Automated Welding and Forming: Modern tube mills that use automated controls ensure that every pipe has consistent wall thickness, ovality, and straightness. For welding, technologies like Laser Beam Welding (LBW)[^1] and Tungsten Inert Gas (TIG) welding, often performed by robotic arms, create a stronger, cleaner, and more reliable weld seam than traditional methods. This is crucial for meeting the stringent standards of the Indian market.

-

Advanced Non-Destructive Testing (NDT): The ability to guarantee a defect-free product is a massive competitive advantage. Integrating online NDT methods directly into the production line is a game-changer. Eddy Current Testing (ECT) can detect surface and subsurface flaws in real-time, allowing for immediate correction and ensuring that 100% of the product meets specifications.

-

Digital Supply Chain Management: Technology isn't just for the factory floor. Using digital platforms for order management, inventory tracking, and logistics coordination provides transparency for both the manufacturer and the client. This builds trust and allows for more efficient planning.

| Technology | Benefit for Indian Market |

|---|---|

| Laser Welding | Flawless, strong weld seams for high-pressure applications |

| Online NDT | Guarantees defect-free pipes, meeting strict quality norms |

| Automation | Consistent dimensional accuracy and higher output |

Conclusion

Success in India's 304L stainless steel pipe market is achievable. It requires a strategic blend of superior product quality, strong local partnerships, and investment in modern technology. By focusing on these pillars, manufacturers can meet the demands of this booming economy and build a lasting presence.

Have Questions or Need More Information?

Get in touch with us for personalized assistance and expert advice.